Retirement

Senator slams superannuation industry’s ‘complacency and inertia’

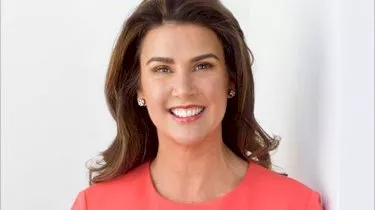

Senator Jane Hume has hit out at the superannuation industry’s use of unnecessary insurance for Australian workers.

Senator slams superannuation industry’s ‘complacency and inertia’

Senator Jane Hume has hit out at the superannuation industry’s use of unnecessary insurance for Australian workers.

At the Financial Services Council Summit held in Sydney yesterday, the Assistant Minister for Superannuation, Financial Services and Financial Technology questioned why the government had to intervene to stop Australians getting a “bad deal” on insurance.

“It’s only now – with the writing on the wall, where it looks like the numbers are there to pass this reform to eliminate unnecessary insurance – that I have a whole bunch of industry players acknowledging ‘oh yeah, we agree something has to be done about this’,” she said.

According to the senator, “young workers deserve a fair go”.

“If they want insurance within super, they should be free to choose it. But, in many cases, the arguments for automatic cover – mainly coming from those with vested interests – are weak,” she offered.

Ms Hume outlined that 96 per cent of people under 25 do not have any dependants and that the premiums paid by women under 25 are more than 330 per cent of the true cost of insuring them.

While acknowledging the work of some funds, such as AustralianSuper, the senator questioned why so many other industry players have been so slow to react.

“If there’s one thing that adds fuel to the perception that the superannuation sector, for all its talk about putting members first, is in reality beset with complacency and inertia, it’s this,” she stated.

“Why isn’t the industry taking action itself on longstanding problems we all know are there, instead of waiting to be dragged kicking and screaming by government towards a solution?”

For some people, putting a stopper to the insurance fee drain can be the difference between being 25 with some savings for retirement or starting with nothing, Ms Hume highlighted.

The system must do better, according to the senator, especially since Australians have to sacrifice one dollar in 10, and which will soon be more.

“The royal commission showed that superannuation funds were not outside the misconduct that plagued the financial sector. The royal commission’s final report included 15 recommendations and one additional measure specifically relating to the superannuation sector,” Ms Hume flagged.

The senator has also called for the industry to proactively eliminate the holding of multiple super accounts by Australians, to prevent persistent sub-par performance by trustees, to ensure boards have excellent governance, and to innovate for the provision of new solutions for income products in retirement.

About the author

About the author

Superannuation

Rest posts healthy returns following a positive end to 2025

Rest, one of Australia's largest profit-to-member superannuation funds, has reported impressive returns in its flagship MySuper Growth investment option for the year 2025. The fund is optimistic about ...Read more

Superannuation

Rest marks milestone with first private equity co-investment exit

In a significant development for Rest, one of Australia’s largest profit-to-member superannuation funds, the organisation has announced the successful completion of its first private equity ...Read more

Superannuation

Expanding super for under-18s could help close the gender super gap, says Rest

In a push to address the gender disparity in superannuation savings, Rest, one of Australia's largest profit-to-member superannuation funds, has called for a significant policy change that would allow ...Read more

Superannuation

Employment Hero pioneers real-time super payments with HeroClear integration

In a significant leap forward for Australia's payroll and superannuation systems, Employment Hero, in collaboration with Zepto and OZEDI, has successfully processed the country's first ...Read more

Superannuation

Rest launches Rest Pay to streamline superannuation payments and boost member outcomes

In a significant move aimed at enhancing compliance with upcoming superannuation regulations, Rest, one of Australia’s largest profit-to-member superannuation funds, has unveiled an innovative ...Read more

Superannuation

Rest appoints experienced governance expert to bolster superannuation fund

Rest, one of Australia's largest profit-to-member superannuation funds, has announced the appointment of Ed Waters as the new Company Secretary. Waters, who brings with him over 15 years of extensive ...Read more

Superannuation

Small businesses brace for cash flow challenges as Payday Super becomes law

With the new Payday Super legislation now enacted, small businesses across Australia are preparing for a significant shift in how they manage superannuation contributions. The law, which mandates a ...Read more

Superannuation

Rest launches Innovate RAP to support fairer super outcomes for First Nations members

In a significant move towards reconciliation and inclusivity, Rest, one of Australia's largest profit-to-member superannuation funds, has unveiled its Innovate Reconciliation Action Plan (RAP)Read more

Superannuation

Rest posts healthy returns following a positive end to 2025

Rest, one of Australia's largest profit-to-member superannuation funds, has reported impressive returns in its flagship MySuper Growth investment option for the year 2025. The fund is optimistic about ...Read more

Superannuation

Rest marks milestone with first private equity co-investment exit

In a significant development for Rest, one of Australia’s largest profit-to-member superannuation funds, the organisation has announced the successful completion of its first private equity ...Read more

Superannuation

Expanding super for under-18s could help close the gender super gap, says Rest

In a push to address the gender disparity in superannuation savings, Rest, one of Australia's largest profit-to-member superannuation funds, has called for a significant policy change that would allow ...Read more

Superannuation

Employment Hero pioneers real-time super payments with HeroClear integration

In a significant leap forward for Australia's payroll and superannuation systems, Employment Hero, in collaboration with Zepto and OZEDI, has successfully processed the country's first ...Read more

Superannuation

Rest launches Rest Pay to streamline superannuation payments and boost member outcomes

In a significant move aimed at enhancing compliance with upcoming superannuation regulations, Rest, one of Australia’s largest profit-to-member superannuation funds, has unveiled an innovative ...Read more

Superannuation

Rest appoints experienced governance expert to bolster superannuation fund

Rest, one of Australia's largest profit-to-member superannuation funds, has announced the appointment of Ed Waters as the new Company Secretary. Waters, who brings with him over 15 years of extensive ...Read more

Superannuation

Small businesses brace for cash flow challenges as Payday Super becomes law

With the new Payday Super legislation now enacted, small businesses across Australia are preparing for a significant shift in how they manage superannuation contributions. The law, which mandates a ...Read more

Superannuation

Rest launches Innovate RAP to support fairer super outcomes for First Nations members

In a significant move towards reconciliation and inclusivity, Rest, one of Australia's largest profit-to-member superannuation funds, has unveiled its Innovate Reconciliation Action Plan (RAP)Read more