Retirement

Coalition rules out ‘adverse tax changes to super’ in budget

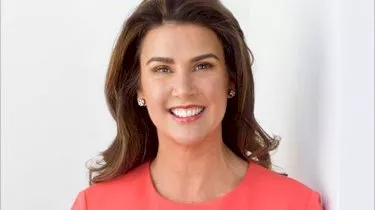

While senator Jane Hume said the government will stand by its election promise of no adverse changes to taxes in super, there will continue to be “necessary tinkering” within the regulatory settings of super.

Coalition rules out ‘adverse tax changes to super’ in budget

While senator Jane Hume said the government will stand by its election promise of no adverse changes to taxes in super, there will continue to be “necessary tinkering” within the regulatory settings of super.

Following speculation that the government may look to implement major changes to the taxation of super in the federal budget this year, senator Jane Hume has promised that there “will be no adverse changes to taxes in superannuation” at a recent Tax Institute conference.

The Morrison government issued a guarantee that it would not implement new taxes on superannuation in the lead-up to the federal election in 2019, following measures announced by Labor to scrap cash refunds on dividend imputation credits, changes to the Division 293 tax threshold and lower non-concessional contribution caps.

The Coalition introduced significant changes to superannuation in 2016, including the $1.6 million transfer balance cap.

Following the economic fallout from COVID-19, however, a number of industry commentators in the superannuation space have predicted that the government may look to make significant policy changes to the age pension system and taxation rate for superannuation as it grapples with the ballooning budget deficit.

While Senator Hume said the government is standing firm on its election promise of no adverse changes to taxes in super, there continues to be “necessary tinkering within the regulatory settings for superannuation”.

“This does not necessarily mean instability and uncertainty for members. It simply means that our superannuation funds are held to the highest standards of accountability and transparency,” she said.

As previously announced, the government will delay introducing the legislation giving effect to the retirement income framework.

“Instead, the government will give effect to a principles-based retirement income covenant for consultation with the industry at a later date,” she stated.

“I’d like to see trustees ensure that members have more options to draw down on their retirement savings in order to maximize their living standards in retirement.”

Superannuation

Rest posts healthy returns following a positive end to 2025

Rest, one of Australia's largest profit-to-member superannuation funds, has reported impressive returns in its flagship MySuper Growth investment option for the year 2025. The fund is optimistic about ...Read more

Superannuation

Rest marks milestone with first private equity co-investment exit

In a significant development for Rest, one of Australia’s largest profit-to-member superannuation funds, the organisation has announced the successful completion of its first private equity ...Read more

Superannuation

Expanding super for under-18s could help close the gender super gap, says Rest

In a push to address the gender disparity in superannuation savings, Rest, one of Australia's largest profit-to-member superannuation funds, has called for a significant policy change that would allow ...Read more

Superannuation

Employment Hero pioneers real-time super payments with HeroClear integration

In a significant leap forward for Australia's payroll and superannuation systems, Employment Hero, in collaboration with Zepto and OZEDI, has successfully processed the country's first ...Read more

Superannuation

Rest launches Rest Pay to streamline superannuation payments and boost member outcomes

In a significant move aimed at enhancing compliance with upcoming superannuation regulations, Rest, one of Australia’s largest profit-to-member superannuation funds, has unveiled an innovative ...Read more

Superannuation

Rest appoints experienced governance expert to bolster superannuation fund

Rest, one of Australia's largest profit-to-member superannuation funds, has announced the appointment of Ed Waters as the new Company Secretary. Waters, who brings with him over 15 years of extensive ...Read more

Superannuation

Small businesses brace for cash flow challenges as Payday Super becomes law

With the new Payday Super legislation now enacted, small businesses across Australia are preparing for a significant shift in how they manage superannuation contributions. The law, which mandates a ...Read more

Superannuation

Rest launches Innovate RAP to support fairer super outcomes for First Nations members

In a significant move towards reconciliation and inclusivity, Rest, one of Australia's largest profit-to-member superannuation funds, has unveiled its Innovate Reconciliation Action Plan (RAP)Read more

Superannuation

Rest posts healthy returns following a positive end to 2025

Rest, one of Australia's largest profit-to-member superannuation funds, has reported impressive returns in its flagship MySuper Growth investment option for the year 2025. The fund is optimistic about ...Read more

Superannuation

Rest marks milestone with first private equity co-investment exit

In a significant development for Rest, one of Australia’s largest profit-to-member superannuation funds, the organisation has announced the successful completion of its first private equity ...Read more

Superannuation

Expanding super for under-18s could help close the gender super gap, says Rest

In a push to address the gender disparity in superannuation savings, Rest, one of Australia's largest profit-to-member superannuation funds, has called for a significant policy change that would allow ...Read more

Superannuation

Employment Hero pioneers real-time super payments with HeroClear integration

In a significant leap forward for Australia's payroll and superannuation systems, Employment Hero, in collaboration with Zepto and OZEDI, has successfully processed the country's first ...Read more

Superannuation

Rest launches Rest Pay to streamline superannuation payments and boost member outcomes

In a significant move aimed at enhancing compliance with upcoming superannuation regulations, Rest, one of Australia’s largest profit-to-member superannuation funds, has unveiled an innovative ...Read more

Superannuation

Rest appoints experienced governance expert to bolster superannuation fund

Rest, one of Australia's largest profit-to-member superannuation funds, has announced the appointment of Ed Waters as the new Company Secretary. Waters, who brings with him over 15 years of extensive ...Read more

Superannuation

Small businesses brace for cash flow challenges as Payday Super becomes law

With the new Payday Super legislation now enacted, small businesses across Australia are preparing for a significant shift in how they manage superannuation contributions. The law, which mandates a ...Read more

Superannuation

Rest launches Innovate RAP to support fairer super outcomes for First Nations members

In a significant move towards reconciliation and inclusivity, Rest, one of Australia's largest profit-to-member superannuation funds, has unveiled its Innovate Reconciliation Action Plan (RAP)Read more