Retirement

Why Aussie super funds are going overseas for growth

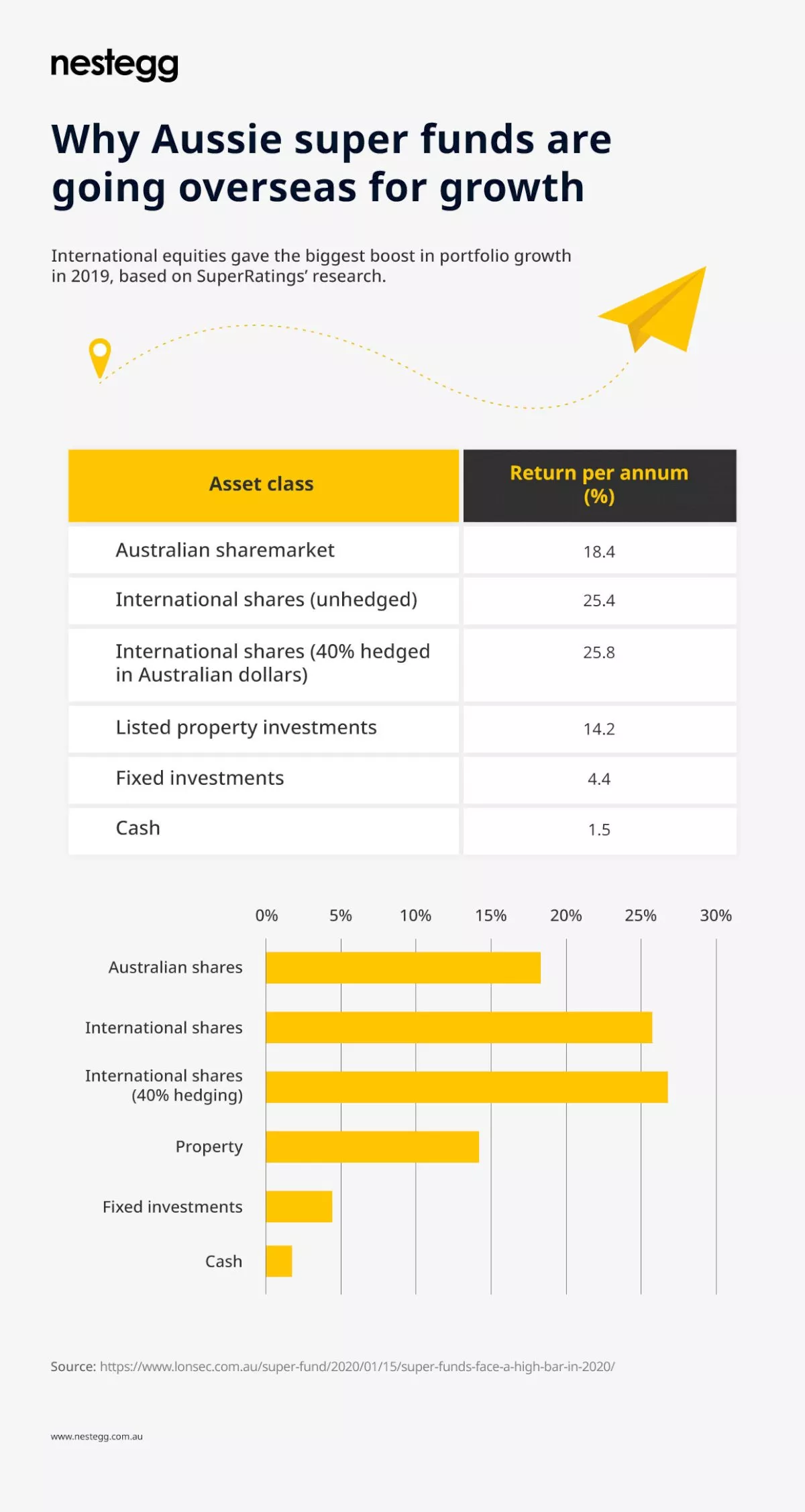

Assets under management are already just shy of $3 trillion in Australian superannuation funds, and are projected to almost double in the next 10 years. Many funds are chasing winners in overseas markets to hit ambitious growth targets.

Why Aussie super funds are going overseas for growth

Currently, superannuation controls 14 per cent of the Australian share market, with that number tipped to rise.

With this, Australian superannuation has an issue: where should it park the additional $3.5 trillion and how can it achieve sustainable growth.

As a way to continue to achieve higher growth for members, superannuation funds take a large portion of its funds overseas as the growth opportunity internationally is far greater than domestically.

Private v public companies

Managing director, Australia, for Fidelity International Alva Devoy believes Chinese markets provide an opportunity for Australian investors.

“We’ve made a lot of money in public markets. But think how well we have done by investing in the public markets, and private equity in particular has delivered 300 basis points over that,” Ms Devoy said.

Despite the tech boom, companies no longer feel the need to go public due to funding through initiatives such as Silicon Valley. Due to this, the total number of shares in the United States has actually fallen by 40 per cent, according to Ms Devoy.

In that 20 years, think how much innovation has happened through start-ups, techs and fintechs. It shows they have not needed to come into the market to secure the funding previously as they are able to achieve credit, the managing director said.

Offshore market bonds

Another way your superannuation fund is continuing to grow besides foreign stocks is offshore bonds.

The Chinese bond market has traditionally grown at 3 per cent, with major investors looking into Chinese corporate bonds.

Hedge funds

Hedge fund managers have had their worst year in a decade, with some of the biggest funds in the world shutting up shop and giving their money back to investors.

There is still investor anger given the high fees and low returns, with TelstraSuper announcing it will cut its ties with any hedge fund manager.

Allison Hill, managing director of investment, QIC, suggests that hedge fund managers can be a worthwhile investment.

“Not all hedge funds are created equal. I think there’s some very good managers with skills and insights, and yes, they can be expensive. However, sometimes the insights and additions they can bring to a portfolio are valuable and worthwhile,” Ms Hill said.

“I think there is also potentially a raft of managers out there that’ll be facing competitive pressures due to either poor performance and the high fee structure. There ability to be able to keep their edge will be quite critical.

“Our view is that they have a valuable role in the portfolio in particular as we are looking for income-orientated alternatives.”

About the author

About the author

Superannuation

Rest posts healthy returns following a positive end to 2025

Rest, one of Australia's largest profit-to-member superannuation funds, has reported impressive returns in its flagship MySuper Growth investment option for the year 2025. The fund is optimistic about...Read more

Superannuation

Rest marks milestone with first private equity co-investment exit

In a significant development for Rest, one of Australia’s largest profit-to-member superannuation funds, the organisation has announced the successful completion of its first private equity co-inves...Read more

Superannuation

Expanding super for under-18s could help close the gender super gap, says Rest

In a push to address the gender disparity in superannuation savings, Rest, one of Australia's largest profit-to-member superannuation funds, has called for a significant policy change that would allow...Read more

Superannuation

Employment Hero pioneers real-time super payments with HeroClear integration

In a significant leap forward for Australia's payroll and superannuation systems, Employment Hero, in collaboration with Zepto and OZEDI, has successfully processed the country's first payroll-embedde...Read more

Superannuation

Rest launches Rest Pay to streamline superannuation payments and boost member outcomes

In a significant move aimed at enhancing compliance with upcoming superannuation regulations, Rest, one of Australia’s largest profit-to-member superannuation funds, has unveiled an innovative clear...Read more

Superannuation

Rest appoints experienced governance expert to bolster superannuation fund

Rest, one of Australia's largest profit-to-member superannuation funds, has announced the appointment of Ed Waters as the new Company Secretary. Waters, who brings with him over 15 years of extensive ...Read more

Superannuation

Small businesses brace for cash flow challenges as Payday Super becomes law

With the new Payday Super legislation now enacted, small businesses across Australia are preparing for a significant shift in how they manage superannuation contributions. The law, which mandates a tr...Read more

Superannuation

Rest launches Innovate RAP to support fairer super outcomes for First Nations members

In a significant move towards reconciliation and inclusivity, Rest, one of Australia's largest profit-to-member superannuation funds, has unveiled its Innovate Reconciliation Action Plan (RAP). This i...Read more

Superannuation

Rest posts healthy returns following a positive end to 2025

Rest, one of Australia's largest profit-to-member superannuation funds, has reported impressive returns in its flagship MySuper Growth investment option for the year 2025. The fund is optimistic about...Read more

Superannuation

Rest marks milestone with first private equity co-investment exit

In a significant development for Rest, one of Australia’s largest profit-to-member superannuation funds, the organisation has announced the successful completion of its first private equity co-inves...Read more

Superannuation

Expanding super for under-18s could help close the gender super gap, says Rest

In a push to address the gender disparity in superannuation savings, Rest, one of Australia's largest profit-to-member superannuation funds, has called for a significant policy change that would allow...Read more

Superannuation

Employment Hero pioneers real-time super payments with HeroClear integration

In a significant leap forward for Australia's payroll and superannuation systems, Employment Hero, in collaboration with Zepto and OZEDI, has successfully processed the country's first payroll-embedde...Read more

Superannuation

Rest launches Rest Pay to streamline superannuation payments and boost member outcomes

In a significant move aimed at enhancing compliance with upcoming superannuation regulations, Rest, one of Australia’s largest profit-to-member superannuation funds, has unveiled an innovative clear...Read more

Superannuation

Rest appoints experienced governance expert to bolster superannuation fund

Rest, one of Australia's largest profit-to-member superannuation funds, has announced the appointment of Ed Waters as the new Company Secretary. Waters, who brings with him over 15 years of extensive ...Read more

Superannuation

Small businesses brace for cash flow challenges as Payday Super becomes law

With the new Payday Super legislation now enacted, small businesses across Australia are preparing for a significant shift in how they manage superannuation contributions. The law, which mandates a tr...Read more

Superannuation

Rest launches Innovate RAP to support fairer super outcomes for First Nations members

In a significant move towards reconciliation and inclusivity, Rest, one of Australia's largest profit-to-member superannuation funds, has unveiled its Innovate Reconciliation Action Plan (RAP). This i...Read more