What is the 50/30/20 budget rule?

You’ve crunched the numbers. You know how much you spend and you have created a budget. You know how much money you need to pay your mortgage, utilities, retirement accounts, as well as your occasional night out. But how does your financial allocation compare to the amount you should ideally spend and save?

Budgeting is a cornerstone habit for building wealth. One approach to creating a budget is the 50/20/30 rule. It is an intuitive way to budget that doesn’t involve detailed budgeting categories. The simple budgeting strategy aims to help people reach their financial goals without the fuss of an overly complicated plan.

In this article, we learn about this method and how to apply it to your finances.

Understanding the 50/30/20 budget plan

The 50/30/20 budget rule came from the book All Your Worth: The Ultimate Lifetime Money Plan, written in 2005 by Elizabeth Warren and her daughter, Amelia Warren Tyagi. Based on over 20 years of research, they introduced this rule to prove that you don’t need to follow a complicated budget to keep your finances in check.

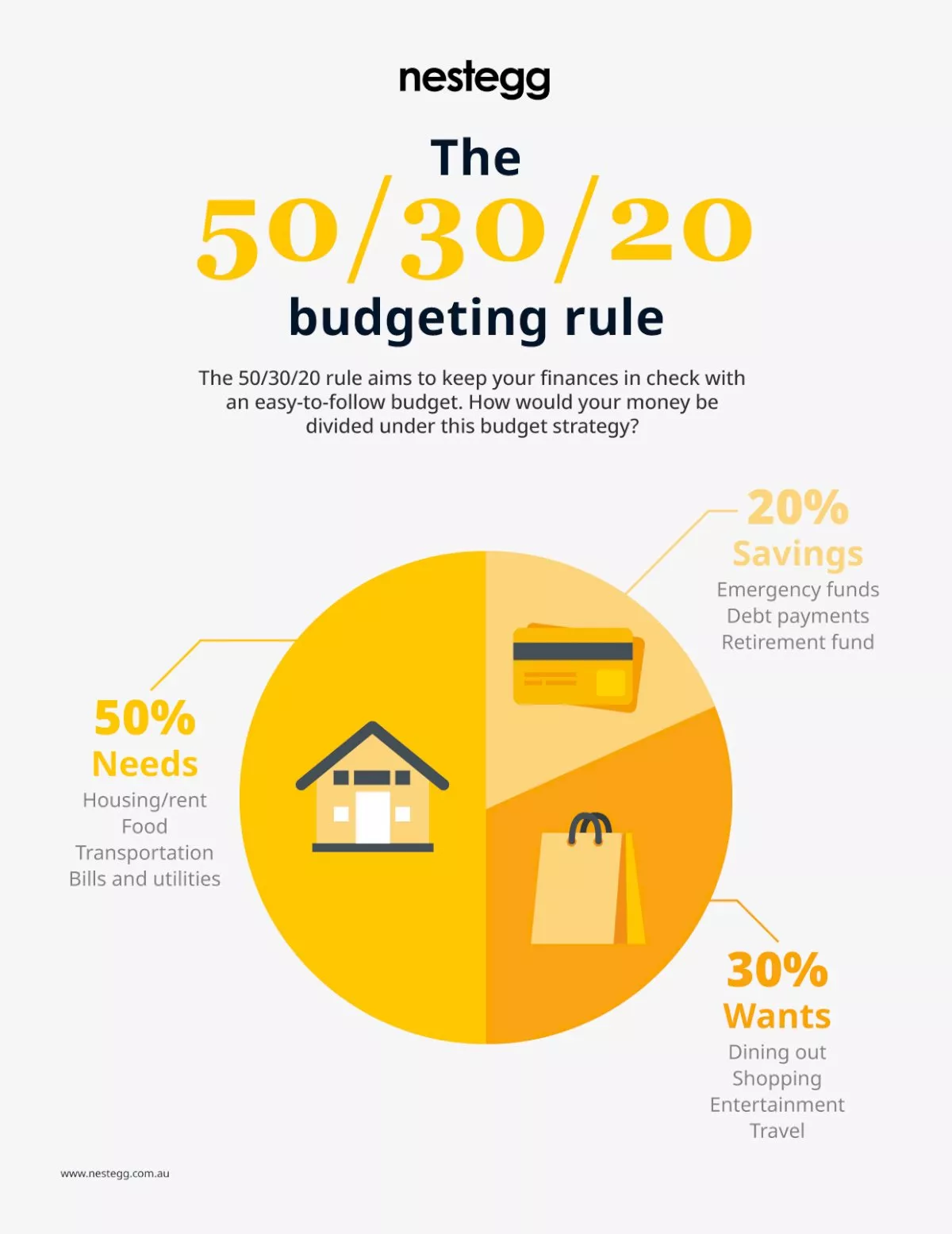

Under this rule, all you need to do is balance your money across three categories of expenses: your needs, wants and savings goals. The easy-to-follow rule allows you to spend less time detailing your finances and the opportunity to focus on the bigger picture.

Here’s what your budget looks like when using the 50/30/20 rule:

Use 50 per cent of your money on your needs

According to this rule, half of your after-tax income should be spent on your needs and obligations. Simply put, needs are expenses that you can’t avoid and are necessary for survival. Needs include rent, electricity and gas bills, transportation, insurance, food and minimum loan repayments.

While this budget may vary from one person to another, if your overall needs expenses are significantly higher than 50 per cent of your after-tax income, the authors suggested making changes that could help you get it under half of your take-home income. For example, looking for a smaller yet more affordable apartment.

Spend 30 per cent of your cash on wants

Your wants consist of things that make your life more enjoyable but are not considered as necessities. This includes dining out, your morning coffee runs and other expenses on entertainment, such as concerts, brunches and watching movies in cinemas. According to the Warrens, 30 percent of your income can be spent on things that you choose to spend your money on, although you could live without them if you had to. Non-essential expenses include clothes shopping, holidays, gym membership and groceries that are not essential (junk food, skin care items etc).

This category also includes the upgrade decisions you make. For example, choosing a more expensive gym membership, buying a more expensive brand of clothing instead of a more economical one. Basically, wants are those little extras you spend money on that make life more enjoyable and entertaining.

If you are spending more than 30 per cent of your income on these things, you will have to either downsize your lifestyle or cut down on wants. Anything in the wants bucket is optional if you boil it down. You can pass up on night outs, cook at home instead of dining out or take public transportation to work.

Stash 20 per cent to savings

Finally, allocate 20 per cent of your net income to your savings and investments. This includes adding money to an emergency fund and any investments you have (bonds, stocks, mutual funds).

Your savings include any and all savings you are setting aside, such as your emergency fund, extra repayments and goal savings. It’s recommended that you have at least three months of emergency savings on hand if you lose your income or an unforeseen event happens. After you build up your emergency fund, focus on increasing your retirement savings and achieving other financial goals, such as saving for a house downpayment.

You can think of this category as your “get ahead” category. You can pay off debt much quicker and you can make significant strides toward a financially secure future by devoting a certain amount of your income into this category.

The term “retirement” might not carry a sense of urgency when you’re only 24 years old, but it certainly will become more pressing in decades to come. Just keep in mind that the advantage of starting early is you will earn compounding interest the longer you let this fund grow.

How to create a 50/30/20 budget

You can create a simple 50/30/20 budgeting plan in five easy steps:

Step 1: Calculate your after-tax income

To figure out the amount for each category, you’ll need to first figure out your after-tax income. And it can’t be any easier. Start with your take-home pay on your paycheck and add back deductions that aren’t taxes. It may include things such as health insurance and superannuation contributions. If you’re self-employed, your after-tax income will be equal to your gross income minus your business expenses.

Once you have your after-tax income, allot 50 per cent of the number for your needs spending, 30 per cent for your wants spending and 20 per cent for debt or savings expenditures.

Step 2: Allocate your money

After identifying the amount you are working with, start recording your 50/30/20 split. The first step is to take out your 50 per cent for your needs. During this process, you must differentiate what your needs and wants are. Remember to set aside 20 per cent for your savings. Be realistic with your budget. If you’re a beginner with budgeting, give yourself room for flexible spending.

Step 3: Hold yourself accountable

Keep yourself responsible by recording your spending. You can track your spending by writing it down in a notebook, using a budgeting app or creating your customised budgeting spreadsheet to keep an eye on your totals as the month progresses. This will also help you see where your money is going and what expenses you can cut down on.

Step 4: Automate your payments and savings

To minimise your effort, automate your bank transfers to your savings account. These days, most utilities make it easy to set up automated payments through your online account. You can choose to activate the function or have it set up.

Step 5: Review your budget

Over time, your income, expenses and prioritise will change. So, don’t forget to adjust your budget accordingly to move with these changes. You may need to increase your allocation for needs upon buying a new house or having a child, or you may lessen your wants if you’ve become more accustomed to economical choices. The most important thing is to always keep a budgeting system in place.

Is the 50/30/20 rule right for you?

The 50/30/20 rule can be a realistic and easy budgeting strategy for some people. However, whether it is the right one for you depends on your personal circumstances.

For some people, the lack of details can be problematic. The vagueness of each category makes it all too easy to hide bad spending habits and make unnecessary purchases just because you can. For others, the lack of structure makes it more difficult for them to find ways to improve their spending habits.

Finally, the 50/30/20 budgeting method is not considered as a long-term way to manage your finances. Because it doesn’t prioritise your savings, this method is considered unsustainable. If you want to retire comfortably someday, you’ll need to boost your savings rate.

But the 50/30/20 budgeting method is not all bad. If you’re a rookie when it comes to budgeting, this rule can be a great stepping stone. It’s also important to realise that there are other budgeting solutions to try, especially if you have specific financial goals in mind.

Want to learn more about budgeting? Explore nestegg today!

How to budget

Help to Buy switches on in WA: What the shared‑equity rollout means for banks, brokers and builders

Western Australia has joined the federal Help to Buy program, flipping the switch on a new stream of first‑home demand. The shared‑equity model reshapes risk, margins and distribution for lenders ...Read more

How to budget

Australia’s first-home buyer reset: how policy, rates and competition will shape the rebound

After a flat first half of 2025, first-home buyer (FHB) activity is set to lift—nudged by a five per cent deposit guarantee and the Reserve Bank’s first rate cut since 2020. But a rebound won’t ...Read more

How to budget

Australians Seek Bargains to Stretch Christmas Budgets Amid Rising Costs

As the festive season approaches, Australians are preparing to spend more on Christmas gifts and festive feasts compared to previous years. However, despite larger budgets, many are still on the hunt ...Read more

How to budget

Australians grapple with stubborn cost of living in 2025

In a year marked by persistent financial strain, only a meagre 7% of Australians believe that the cost of living has improved, according to the 2025 Household Budget Barometer released by Compare the ...Read more

How to budget

How to take control amid rising electricity costs

Energy bills are increasing for almost nine in ten Australians, forcing many to think outside the box when it comes to keeping costs and electricity usage down. While some are resorting to showering a...Read more

How to budget

Aussies get savvy with energy hacks as costs surge

As energy costs continue to climb across Australia, a recent study commissioned by Zip Co (ASX: ZIP) reveals that 91% of Australians are actively seeking innovative ways to reduce their energy bills. ...Read more

How to budget

The psychology behind saving: Understanding and overcoming common barriers

Saving money is a fundamental aspect of financial security, yet many people find it difficult to set aside a portion of their income regularly. ...Read more

How to budget

Smart saving tips for first home buyers in Australia

Purchasing your first home is a significant milestone, but the path to homeownership in Australia can seem daunting due to the high property prices and competitive market. However, with the right stra...Read more

How to budget

Help to Buy switches on in WA: What the shared‑equity rollout means for banks, brokers and builders

Western Australia has joined the federal Help to Buy program, flipping the switch on a new stream of first‑home demand. The shared‑equity model reshapes risk, margins and distribution for lenders ...Read more

How to budget

Australia’s first-home buyer reset: how policy, rates and competition will shape the rebound

After a flat first half of 2025, first-home buyer (FHB) activity is set to lift—nudged by a five per cent deposit guarantee and the Reserve Bank’s first rate cut since 2020. But a rebound won’t ...Read more

How to budget

Australians Seek Bargains to Stretch Christmas Budgets Amid Rising Costs

As the festive season approaches, Australians are preparing to spend more on Christmas gifts and festive feasts compared to previous years. However, despite larger budgets, many are still on the hunt ...Read more

How to budget

Australians grapple with stubborn cost of living in 2025

In a year marked by persistent financial strain, only a meagre 7% of Australians believe that the cost of living has improved, according to the 2025 Household Budget Barometer released by Compare the ...Read more

How to budget

How to take control amid rising electricity costs

Energy bills are increasing for almost nine in ten Australians, forcing many to think outside the box when it comes to keeping costs and electricity usage down. While some are resorting to showering a...Read more

How to budget

Aussies get savvy with energy hacks as costs surge

As energy costs continue to climb across Australia, a recent study commissioned by Zip Co (ASX: ZIP) reveals that 91% of Australians are actively seeking innovative ways to reduce their energy bills. ...Read more

How to budget

The psychology behind saving: Understanding and overcoming common barriers

Saving money is a fundamental aspect of financial security, yet many people find it difficult to set aside a portion of their income regularly. ...Read more

How to budget

Smart saving tips for first home buyers in Australia

Purchasing your first home is a significant milestone, but the path to homeownership in Australia can seem daunting due to the high property prices and competitive market. However, with the right stra...Read more