Save

$20,000 small business tax break explained

The government has given the small business sector a much-needed tax break by allowing owners to claim a tax deduction for purchased assets amounting below $20,000.

$20,000 small business tax break explained

The government has given the small business sector a much-needed tax break by allowing owners to claim a tax deduction for purchased assets amounting below $20,000.

According to the provision, small business entities can immediately claim the tax deduction if both the entity and purchased asset are eligible. However, not all business-related purchases are covered.

Here’s a quick breakdown of the tax scheme to better understand what it’s about.

What is the $20,000 small business tax break?

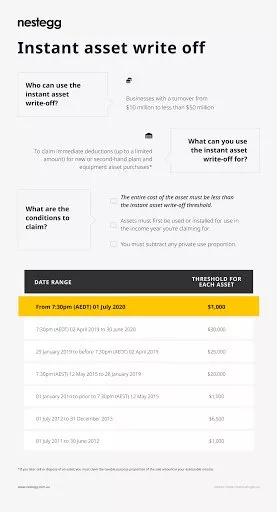

The ‘$20,000 instant asset write-off’ is a 2015-proposed tax scheme that grants small business owners an immediate tax deduction for assets purchased under $20,000.

The tax relief, which aims to help businesses with an annual turnover less than $2 million, was originally intended to apply from 2015 to 2017. The government, however, extended the provision until June 30, 2018.

Note that deductions may only be claimed against the business portion of an asset—items with shared business and personal use would only be allowed partial tax relief. Business owners may also claim deductions by using the simplified depreciation rules, which apply to second-hand items or a pool of depreciating assets purchased for $20,000 or higher.

Who can apply for the tax break?

The tax relief was proposed to encourage small businesses make necessary purchases and to see an increase in business activities. With the extension through 2018, however, the government increased the turnover to $10 million, allowing more businesses to claim deductions.

According to the Australian Taxation Office (ATO), the following are eligible to claim the $20,000 instant asset write-off:

- small business entities with Australian Business Number (ABN); and,

- sole traders or self-employed individuals

In both cases, the entity’s turnover must be less than $10 million and the asset purchased for business use should cost below $20,000.

Are all big purchases allowed?

Only purchases that are related to and necessary for the business operations are eligible for the tax relief. If the purchased item will only be partially used for business, the owner may only claim a deduction for the portion to be used for business. However, the business should be the main entity that will benefit from the purchase.

For instance, if Katie purchases a high end computer set that will be used for her business 80 per cent of the time, she can only claim the deduction for 80 per cent of its total value.

A big business purchase that will be leased to another entity or is used for anything other than the main business 50 per cent of the time will not be granted a tax break.

What kinds of items are allowed?

Equipment, hardware and vehicles, whether brand-new or second-hand, are eligible for the tax relief if it is for business use.

Most software and programs required to run the business are also included, except for in-house developed software.

The above-mentioned items must be purchased for below $20,000, otherwise, the owner may have to place the item in an asset pool and apply the simplified depreciation rules for small businesses. An item added to the asset pool may not claim a tax break unless its value depreciates to under $20,000.

Simplified asset depreciation rules

Small business entities benefit from a very generous and very simplified depreciation rules for the tax break.

Here’s how it works:

- Only a 15 per cent deduction is allowed on the year the asset was purchased, and

- 30 per cent may be claimed for each year afterwards.

If the asset’s remaining value falls below $20,000 after the deduction, then the business may claim a write-off for the full remaining value in the next tax return. If the remaining value still exceeds the threshold, they must claim only 30 per cent of the remaining value in the succeeding years until it crosses the threshold.

How to apply the tax break and asset depreciation

Applying the tax break on eligible assets is pretty straightforward: just indicate the full amount as tax deduction under the business portion of their tax return.

If the purchase price exceeds $20,000, they may only claim 15 per cent of the amount on the year it was purchased and 30 per cent for each succeeding year until they can write-off the amount.

For instance, if Bob purchased a new tractor worth $28,000 in 2015 to increase the productivity in his farm, he would not be able to claim the tax deduction immediately.

If Bob did not buy any other asset for business since that year, the computation will be as follows:

| Financial Year | Asset value/ Balance | Status | Deductible amount | Action |

| 2015–2016 | $28,000 | Exceeds threshold | $4,200 (15 per cent) | Keep in pool |

| 2016-2017 | $23,800 | Exceeds threshold | $7,140 (30 per cent) | Keep in pool |

| 2017-2018 | $16,600 | Within threshold | $16,600 | Write-off |

However, business owners are still advised to be reasonable with their purchases despite the generous calculations and tax breaks. Only purchase necessary assets that will help the business grow further because the government can still reject deduction claims if the purchase is not found to benefit business needs.

This information has been sourced from the Australian Taxation Office.

About the author

About the author

Tax saving

$20,000 instant asset write-off extension welcomed, but calls for broader support grow

The Australian government's decision to extend the $20,000 instant asset write-off into the next financial year has been met with approval from business leaders. However, there are growing calls for m...Read more

Tax saving

The downsizer dividend: How targeted tax levers could unlock housing supply in Australia

A call by Raine & Horne to incentivise seniors to move to smaller homes has kicked off a wider policy conversation that reaches well beyond real estate. If designed well, a targeted package could ...Read more

Tax saving

Raine & Horne's bold move could unlock housing supply but what are the hidden risks

Raine & Horne’s call for targeted tax incentives to encourage empty nesters to ‘rightsize’ isn’t just another sector wish list; it’s a potential lever to free up family homes, ease renta...Read more

Tax saving

From annual check-ups to always‑on: how modern portfolio reviews unlock after‑tax alpha

The era of once‑a‑year portfolio check‑ins is over. Continuous, tech‑enabled reviews now drive returns through tax efficiency, risk control and behavioural discipline—especially in a high‑...Read more

Tax saving

Navigating tax laws for capital gains in 2023

The landscape of Australian tax laws surrounding capital gains is ever-changing, with 2023 being no exception. ...Read more

Tax saving

What you need to know about the tax implications of crypto

One million Aussies are now invested in crypto, but many have not thought about how these investments will affect them at tax time. ...Read more

Tax saving

Welfare overhaul could give recipients a leg-up

Australia’s Centrelink recipients who’ve been doing it tough are in for a potentially easier time if the federal government pursues ambitious reforms that could provide sturdier safety nets. ...Read more

Tax saving

Students should think twice before tapping into their super

Former students might want to think carefully before they look to take advantage of the federal government’s biggest first home buyer incentive. ...Read more

Tax saving

$20,000 instant asset write-off extension welcomed, but calls for broader support grow

The Australian government's decision to extend the $20,000 instant asset write-off into the next financial year has been met with approval from business leaders. However, there are growing calls for m...Read more

Tax saving

The downsizer dividend: How targeted tax levers could unlock housing supply in Australia

A call by Raine & Horne to incentivise seniors to move to smaller homes has kicked off a wider policy conversation that reaches well beyond real estate. If designed well, a targeted package could ...Read more

Tax saving

Raine & Horne's bold move could unlock housing supply but what are the hidden risks

Raine & Horne’s call for targeted tax incentives to encourage empty nesters to ‘rightsize’ isn’t just another sector wish list; it’s a potential lever to free up family homes, ease renta...Read more

Tax saving

From annual check-ups to always‑on: how modern portfolio reviews unlock after‑tax alpha

The era of once‑a‑year portfolio check‑ins is over. Continuous, tech‑enabled reviews now drive returns through tax efficiency, risk control and behavioural discipline—especially in a high‑...Read more

Tax saving

Navigating tax laws for capital gains in 2023

The landscape of Australian tax laws surrounding capital gains is ever-changing, with 2023 being no exception. ...Read more

Tax saving

What you need to know about the tax implications of crypto

One million Aussies are now invested in crypto, but many have not thought about how these investments will affect them at tax time. ...Read more

Tax saving

Welfare overhaul could give recipients a leg-up

Australia’s Centrelink recipients who’ve been doing it tough are in for a potentially easier time if the federal government pursues ambitious reforms that could provide sturdier safety nets. ...Read more

Tax saving

Students should think twice before tapping into their super

Former students might want to think carefully before they look to take advantage of the federal government’s biggest first home buyer incentive. ...Read more