Retirement

How the new contribution rules could boost your super

By utilising the new deductible contribution rules and committing to tipping money into super early, plenty of Australians can achieve a balance of $1 million by age 65, says HLB Mann Judd.

How the new contribution rules could boost your super

By utilising the new deductible contribution rules and committing to tipping money into super early, plenty of Australians can achieve a balance of $1 million by age 65, says HLB Mann Judd.

The rule changes to super on 1 July 2017 have made it much easier to make additional contributions to super, says HLB Mann Judd wealth management partner Jonathan Philpot.

One of the pivotal changes has been to deductible contributions to super. Before 1 July 2017, only self-employed people could claim personal super contributions as a tax deduction.

But according to the Australian Taxation Office, "most people under under 75 years old will [now] be able to claim a tax deduction on personal superannuation contributions".

Mr Philpot says that means Australians can use personally deductible contributions to start building their super balances from a much younger age.

"In the past, employees had to elect to salary-sacrifice in order to make additional superannuation contributions and receive the associated tax savings. Now, people earning salary and wages are able to make voluntary contributions to superannuation on their own behalf and claim a tax deduction in their personal tax return," Mr Philpot said.

"In fact, people will need to start consciously building their superannuation in their 40s, and should be trying to contribute as close to the maximum of $25,000 a year as they can, as their main form of long-term savings.

"By making additional deductible contributions through to age 65, people can significantly grow their super balance and potentially get it well above a million dollars," he said.

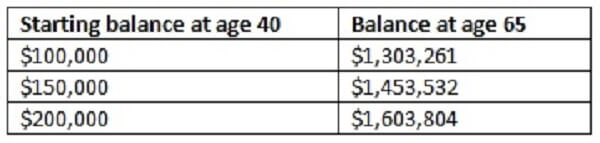

Mr Philpot gave an example of a 40-year-old with a super balance of $100,000 who commits to making the maximum concessional contribution of $25,000 a year, laid out in the table below.

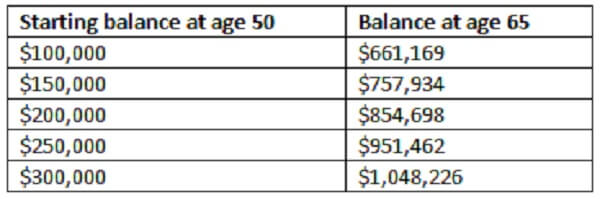

In contrast, he said, a 50-year-old with the same opening balance would be significantly worse off:

"For most people in their 40s, repaying the home mortgage is — understandably — the main focus. While this should continue to a be a focus, once people have their mortgage under control, it is worth considering using the offset account to make additional concessional contributions to super," Mr Philpot said.

"Relying solely on the superannuation guarantee contribution of 9.5 per cent is unlikely to allow most people to save enough for a comfortable retirement – something that many people still seem to be unaware of."

He added that the new changes to superannuation contributions doesn’t automatically spell the end of salary sacrifice arrangements.

"The changes don’t necessarily mean people should cease their salary sacrifice arrangements, as they have two main benefits.

"Firstly, it is an automated savings option, making it easier for people to chip away at growing their wealth as it can be a struggle to come up with funds at year end to contribute to superannuation.

"Secondly the tax benefit is immediate, as it is pre-tax dollars that are salary sacrificed, whereas when using the personal contribution method people have to wait until lodging their tax return for the tax refund," Mr Philpot said.

Superannuation

Rest posts healthy returns following a positive end to 2025

Rest, one of Australia's largest profit-to-member superannuation funds, has reported impressive returns in its flagship MySuper Growth investment option for the year 2025. The fund is optimistic about ...Read more

Superannuation

Rest marks milestone with first private equity co-investment exit

In a significant development for Rest, one of Australia’s largest profit-to-member superannuation funds, the organisation has announced the successful completion of its first private equity ...Read more

Superannuation

Expanding super for under-18s could help close the gender super gap, says Rest

In a push to address the gender disparity in superannuation savings, Rest, one of Australia's largest profit-to-member superannuation funds, has called for a significant policy change that would allow ...Read more

Superannuation

Employment Hero pioneers real-time super payments with HeroClear integration

In a significant leap forward for Australia's payroll and superannuation systems, Employment Hero, in collaboration with Zepto and OZEDI, has successfully processed the country's first ...Read more

Superannuation

Rest launches Rest Pay to streamline superannuation payments and boost member outcomes

In a significant move aimed at enhancing compliance with upcoming superannuation regulations, Rest, one of Australia’s largest profit-to-member superannuation funds, has unveiled an innovative ...Read more

Superannuation

Rest appoints experienced governance expert to bolster superannuation fund

Rest, one of Australia's largest profit-to-member superannuation funds, has announced the appointment of Ed Waters as the new Company Secretary. Waters, who brings with him over 15 years of extensive ...Read more

Superannuation

Small businesses brace for cash flow challenges as Payday Super becomes law

With the new Payday Super legislation now enacted, small businesses across Australia are preparing for a significant shift in how they manage superannuation contributions. The law, which mandates a ...Read more

Superannuation

Rest launches Innovate RAP to support fairer super outcomes for First Nations members

In a significant move towards reconciliation and inclusivity, Rest, one of Australia's largest profit-to-member superannuation funds, has unveiled its Innovate Reconciliation Action Plan (RAP)Read more

Superannuation

Rest posts healthy returns following a positive end to 2025

Rest, one of Australia's largest profit-to-member superannuation funds, has reported impressive returns in its flagship MySuper Growth investment option for the year 2025. The fund is optimistic about ...Read more

Superannuation

Rest marks milestone with first private equity co-investment exit

In a significant development for Rest, one of Australia’s largest profit-to-member superannuation funds, the organisation has announced the successful completion of its first private equity ...Read more

Superannuation

Expanding super for under-18s could help close the gender super gap, says Rest

In a push to address the gender disparity in superannuation savings, Rest, one of Australia's largest profit-to-member superannuation funds, has called for a significant policy change that would allow ...Read more

Superannuation

Employment Hero pioneers real-time super payments with HeroClear integration

In a significant leap forward for Australia's payroll and superannuation systems, Employment Hero, in collaboration with Zepto and OZEDI, has successfully processed the country's first ...Read more

Superannuation

Rest launches Rest Pay to streamline superannuation payments and boost member outcomes

In a significant move aimed at enhancing compliance with upcoming superannuation regulations, Rest, one of Australia’s largest profit-to-member superannuation funds, has unveiled an innovative ...Read more

Superannuation

Rest appoints experienced governance expert to bolster superannuation fund

Rest, one of Australia's largest profit-to-member superannuation funds, has announced the appointment of Ed Waters as the new Company Secretary. Waters, who brings with him over 15 years of extensive ...Read more

Superannuation

Small businesses brace for cash flow challenges as Payday Super becomes law

With the new Payday Super legislation now enacted, small businesses across Australia are preparing for a significant shift in how they manage superannuation contributions. The law, which mandates a ...Read more

Superannuation

Rest launches Innovate RAP to support fairer super outcomes for First Nations members

In a significant move towards reconciliation and inclusivity, Rest, one of Australia's largest profit-to-member superannuation funds, has unveiled its Innovate Reconciliation Action Plan (RAP)Read more