Retirement planning is a long-term commitment that requires discipline to achieve a successful and comfortable retirement without worrying about finances. Many people suggest that at least $1 million is needed in order to retire comfortably, but this amount may not be true for all.

In fact, the Association of Superannuation Funds of Australia (ASFA) projects a lower amount. ASFA estimates that couples need $70,000 or $640,000 in super to achieve a modest or comfortable retirement, respectively.

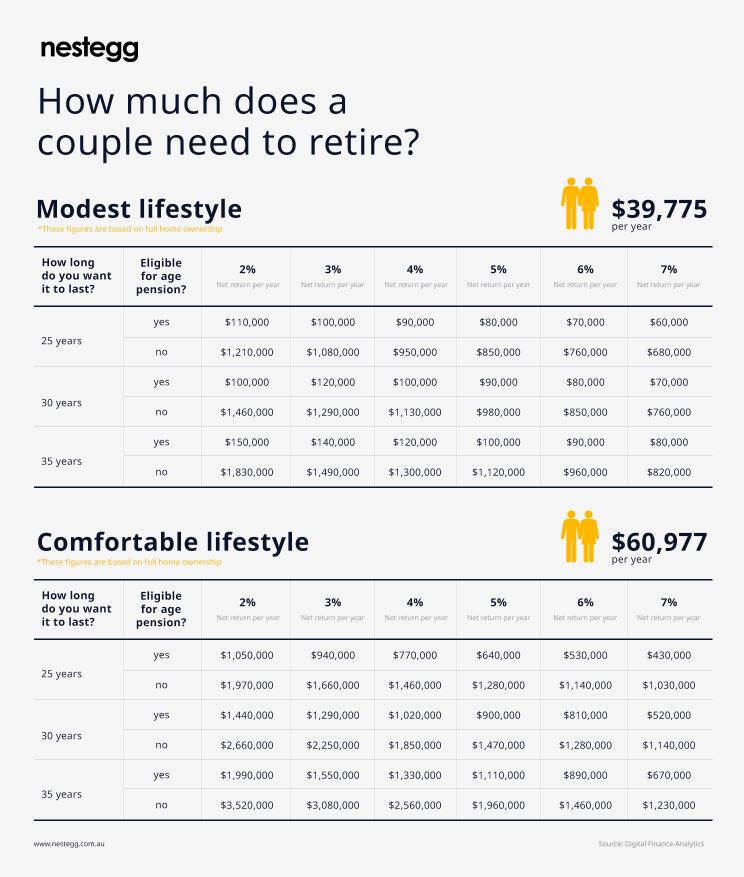

These figures would give couples an income of $39,775 each year for a modest lifestyle and $60,977 annually for a comfortable retirement.

It’s important to note that these figures only apply to retired couples who own their home outright and are relatively healthy.

What does a modest retirement look like?

A modest retirement lifestyle can provide couples with the basic necessities and limited forms of leisure and luxuries.

This type of lifestyle requires couples to keep their spending low and keep to the basics when it comes to household, personal and leisure spending. This means minimal home repairs, limited household items, low utility bills, cheaper cars and infrequent leisure activities.

Should couples wish to take a holiday, they may only be able to afford a holiday within Australia or a few short and budget-friendly breaks.

They can afford basic private health insurance that has limited gap payments, which means they may still be liable to pay some bills from their pockets.

How much do couples need for a modest retirement?

ASFA estimates that couples need at least $70,000 in super to afford a modest retirement. This would give them an income of $39,775 per year or $1,529.81 per fortnight.

These amounts slightly exceed the age pension but only addresses basic necessities – enough for a couple who want to live a simple life.

What does a comfortable retirement look like?

A comfortable retirement provides couples with income to support basic necessities and more leisure activities.

According to ASFA, a comfortable retirement allows a couple to fund home improvements and retain a larger number of furniture and appliances. Couples also have more money to pay for air conditioning, heating and communication expenses.

Likewise, they would be able to afford top level private health insurance, so they don’t have to rely on medicare.

As for leisure activities, couples would be able to afford both domestic and overseas holidays without sacrificing their regular leisure activities.

How much do couples need for a comfortable retirement?

ASFA estimates that couples need $640,000 in their super by the time they retire in order to receive an income of $60,977 per year or $2,345.27 per fortnight. These amounts would already afford couples with a comfortable lifestyle in retirement.

These amounts can provide couples with a bigger budget to use better quality items (i.e. clothes), appliances and furniture, as well as enough money to pay for a variety of leisure activities regularly.

How accurate are the ASFA projections?

The ASFA retirement standards may be more objective and precise over other measures since it takes expenses into consideration. Likewise, ASFA updates its projections quarterly so that its standards reflect changes in the consumer price index.

However, the actual super balance required may change depending on several factors, such as:

- the portfolio’s annual net return

- whether one or both parties qualify for age pension

- the retirees’ longevity or time horizon (how long the super needs to last)

As shown in the calculation referenced in nestegg’s infographic, the required savings in super may actually be higher or lower than ASFA’s estimates – but it depends on the couple’s portfolio.

This is because the type of investment portfolio influences their potential net returns.

For instance, the $70,000 ASFA estimate for a couple’s modest retirement matches the amount required if the couple is eligible for age pension and their portfolio returns a consistent 6 per cent annually. Furthermore, this will only last them 25 years without supplementary income.

The same is true for a comfortable lifestyle: ASFA’s standards apply to age pension-eligible couples invested in a portfolio with 5 per cent annual net returns. This would also last them 25 years.

The super savings a couple needs to retire would significantly increase if they are invested in a portfolio with lower net returns, don’t qualify for age pension or their retirement exceeds 25 years.

Note that the estimates in the table are for illustrative purposes only and should not be taken as advice. The figures doesn’t take fees, taxes, inflation and market movements into consideration.

It’s best to seek the advice of a licensed professional who can take your personal circumstances and objectives into consideration.

About the author

Join The Nest Egg community

We Translate Complicated Financial Jargon Into Easy-To-Understand Information For Australians

Your email address will be shared with nestegg and subject to our Privacy Policy

About the author

Join The Nest Egg community

We Translate Complicated Financial Jargon Into Easy-To-Understand Information For Australians

Your email address will be shared with nestegg and subject to our Privacy Policy

Rest posts healthy returns following a positive end to 2025

Rest marks milestone with first private equity co-investment exit

Expanding super for under-18s could help close the gender super gap, says Rest

Employment Hero pioneers real-time super payments with HeroClear integration

Rest launches Rest Pay to streamline superannuation payments and boost member outcomes