Retirement

How to become an SMSF trustee

Some people prefer to handle their own retirement savings by becoming trustees of a self-managed super fund (SMSF). Serving as an SMSF trustee is a huge responsibility because they have a lot of duties to perform and must always be informed of changes in super and tax laws. Since they have a legal obligation to uphold all the objectives of their trust fund, trustees could face steep punishment for breaching regulations.

How to become an SMSF trustee

Here’s a quick guide on how to become an SMSF trustee in spite of the responsibilities and risks.

Confirm your eligibility

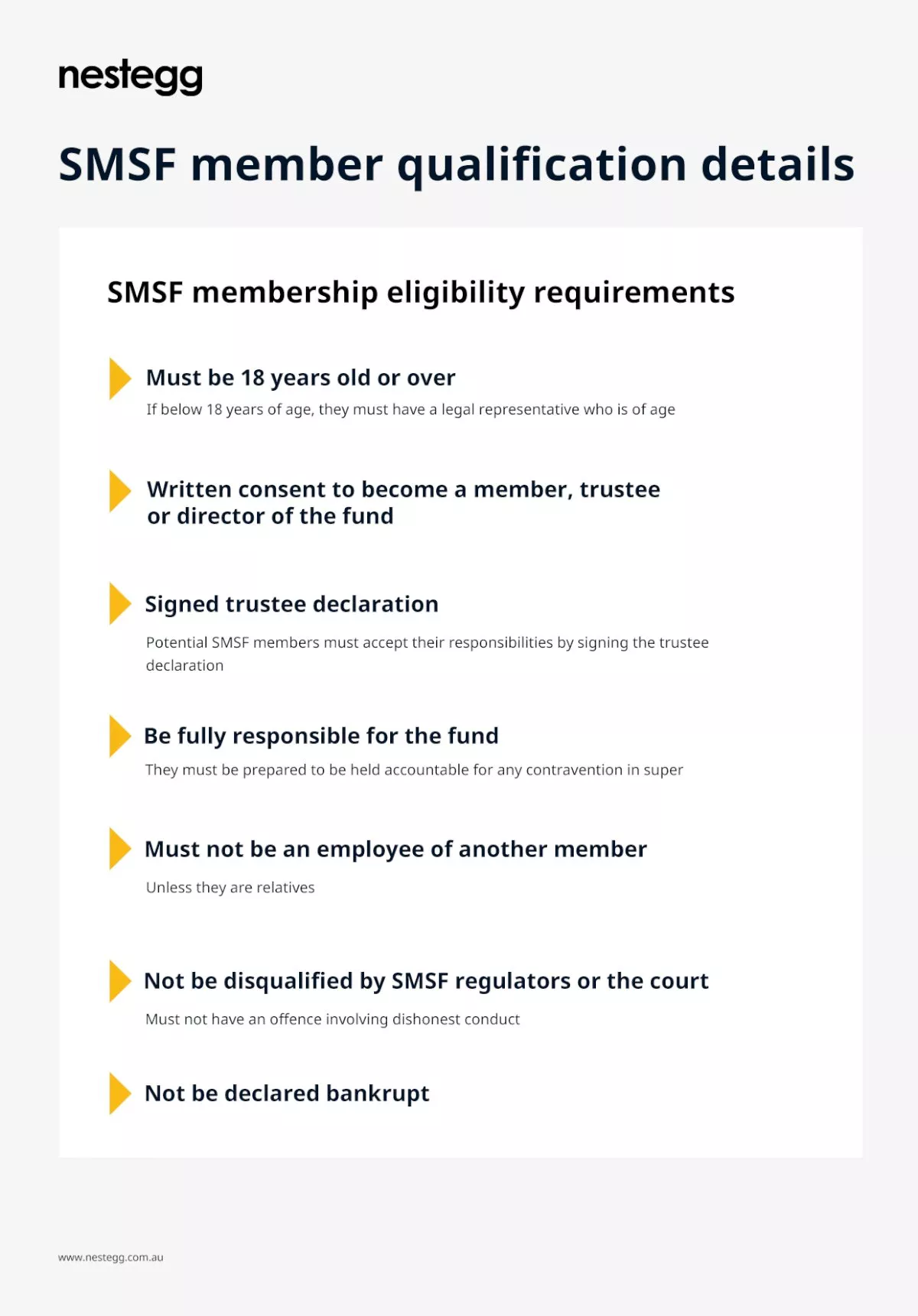

Ensure that the Australian Taxation Office (ATO) commissioner does not find a reason for disqualification by meeting these eligibility requirements:

- Must be at least 18 years old (a legal representative may act on behalf of minors)

- Are not legally disabled (i.e., mentally incapacitated)

- Have not been convicted of offences relating to dishonesty

- Have not been penalised under super laws

- Have not been disqualified by regulators (e.g., ATO) or the court

- Are not insolvent under administration (not under financial distress such as bankruptcy)

The SMSF is managed for the retirement benefits of its members. This means all trustees should have assets within the fund.

Get appointed as a trustee

There are actually two ways to become an SMSF trustee: the first option is to join an existing SMSF as a trustee and the second is to establish an SMSF.

Joining an existing SMSF

Appointed trustees to existing SMSFs only need to sign the trust declaration and other existing legal documents pertaining to the fund within 21 days of appointment.

After signing legal documents, the SMSF needs to confirm the new trustee’s appointment by informing appropriate regulators and amending their fund’s documents. This may be costly for SMSFs, depending on its structure, so ensure proper understanding of the fund’s objectives.

Registering a new SMSF

Decide what kind of trust to create. The number of people involved in the SMSF depends on its structure—especially if it is a single-member fund—so knowing the differences between an individual and corporate trustee is important.

Know, understand and perform responsibilities

All trustees are equally responsible for managing the SMSF. Make sure to contribute to the management of the fund.

Any error or shortcoming by one trustee can affect all other members or even the whole fund. Regulatory bodies do not accept excuses such as “but that wasn’t my mistake”.

Prepare for the worst

SMSFs are meant to financially secure its members’ throughout their retirement, but unexpected events such as terminal illness and sudden death can happen.

Trustees are responsible for ensuring that the deceased member’s nominated beneficiaries will receive the appropriate benefits as outlined by Super and tax laws and the trust deed. It’s also important to prepare for what could happen to the fund if any change in membership occurs.

This information has been sourced from the Australian Taxation Office.

About the author

About the author

Self managed super fund

Financial progress hinges on ambition, not income, says Stake Report

Australia faces a financial turning point, with new research from online investment platform Stake revealing a nation divided into two distinct groups: the 'Starters', who invest and feel in control o...Read more

Self managed super fund

OKX targets Australia's $1 trillion SMSF market with new crypto platform launch

In a significant move aimed at capitalising on Australia's burgeoning digital asset market, global onchain technology company OKX has unveiled a new Self-Managed Super Fund (SMSF) expansion on its cry...Read more

Self managed super fund

Industry leaders launch SMSF Innovation Council to drive digital transformation

A consortium of finance industry leaders has launched an SMSF Innovation Council to help Australia's $1.02 trillion self-managed superannuation fund industry navigate digital transformation. ...Read more

Self managed super fund

Superannuation guarantee to be paid on government paid parental leave, says ASFA

The Association of Superannuation Funds of Australia (ASFA) has hailed the government's decision to include Superannuation Guarantee payments with its Paid Parental Leave policy as a critical step tow...Read more

Self managed super fund

SMSF experts advise against hasty reactions to potential super tax changes

As the Australian Government proposes a new tax measure on superannuation earnings for balances exceeding $3 million, experts from the self-managed super funds (SMSF) sector are urging members not to ...Read more

Self managed super fund

Federal government announces changes to superannuation contribution caps

The Federal Government has announced changes to the superannuation contribution caps, impacting self-managed super funds (SMSFs) and their members from 1 July 2024. ...Read more

Self managed super fund

SMSF Association calls for joint effort to tackle early super access

The SMSF Association is calling on a collaborative approach including the Government, the Australian Taxation Office (ATO), the Australian Securities and Investments Commission (ASIC), and the superan...Read more

Self managed super fund

Rest Super members file class action over alleged insurance premium deductions

Shine Lawyers has initiated a class action lawsuit against Rest Superannuation (Rest), alleging the unlawful deduction of income protection insurance premiums from members' superannuation accounts. ...Read more

Self managed super fund

Financial progress hinges on ambition, not income, says Stake Report

Australia faces a financial turning point, with new research from online investment platform Stake revealing a nation divided into two distinct groups: the 'Starters', who invest and feel in control o...Read more

Self managed super fund

OKX targets Australia's $1 trillion SMSF market with new crypto platform launch

In a significant move aimed at capitalising on Australia's burgeoning digital asset market, global onchain technology company OKX has unveiled a new Self-Managed Super Fund (SMSF) expansion on its cry...Read more

Self managed super fund

Industry leaders launch SMSF Innovation Council to drive digital transformation

A consortium of finance industry leaders has launched an SMSF Innovation Council to help Australia's $1.02 trillion self-managed superannuation fund industry navigate digital transformation. ...Read more

Self managed super fund

Superannuation guarantee to be paid on government paid parental leave, says ASFA

The Association of Superannuation Funds of Australia (ASFA) has hailed the government's decision to include Superannuation Guarantee payments with its Paid Parental Leave policy as a critical step tow...Read more

Self managed super fund

SMSF experts advise against hasty reactions to potential super tax changes

As the Australian Government proposes a new tax measure on superannuation earnings for balances exceeding $3 million, experts from the self-managed super funds (SMSF) sector are urging members not to ...Read more

Self managed super fund

Federal government announces changes to superannuation contribution caps

The Federal Government has announced changes to the superannuation contribution caps, impacting self-managed super funds (SMSFs) and their members from 1 July 2024. ...Read more

Self managed super fund

SMSF Association calls for joint effort to tackle early super access

The SMSF Association is calling on a collaborative approach including the Government, the Australian Taxation Office (ATO), the Australian Securities and Investments Commission (ASIC), and the superan...Read more

Self managed super fund

Rest Super members file class action over alleged insurance premium deductions

Shine Lawyers has initiated a class action lawsuit against Rest Superannuation (Rest), alleging the unlawful deduction of income protection insurance premiums from members' superannuation accounts. ...Read more