Retirement

Franking credit changes won’t force Aussies onto the pension: Shorten

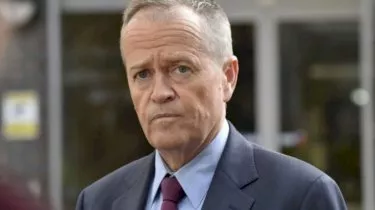

In defence of his contentious changes to the franking credits regime in Australia, Opposition Leader Bill Shorten said self-funded retirees won’t be pushed onto the public purse under his government.

Franking credit changes won’t force Aussies onto the pension: Shorten

In defence of his contentious changes to the franking credits regime in Australia, Opposition Leader Bill Shorten said self-funded retirees won’t be pushed onto the public purse under his government.

In March last year, the Labor Party announced plans to scrap cash refunds on excess dividend imputation credits. There are exceptions for pensioners.

The policy has since been a heated source of debate among Australian investors, with some arguing that mum-and-dad investors with modest incomes will be adversely impacted.

Mr Shorten has again launched a defence of the policy on the national broadcaster, saying the proposal will not force self-funded retirees onto the public purse.

Mr Shorten was asked if the proposed changes to franking credits would mean that self-funded retirees like Chris Phillips, who currently receives $9,000 in franking credit refunds out of a $36,000-a-year income, would be forced to rely “on the public purse”.

“He already is, and this is the real heart of the issue,” Mr Shorten said.

“When you get an income tax credit when you haven’t paid income tax, it’s a gift from the government. You’re already on the public purse.

“But the criteria by which you get this money is that you happen to own shares, and [Prime Minister Scott] Morrison has been most dishonest on this where he says we are coming for people’s savings – no, we’re not – and he’s been dishonest by saying this is a tax.”

Many fund managers have blasted the policy, particularly those that directly deal in Australian equities, but others like Plato Asset Management have called for calm in recent days.

“Franking credits are still around, and most people can still use them,” said director Dr Don Hamson.

“Most people will still get the benefit of franking credits, even ones that will lose a little bit will only be about 10 per cent,” he said.

“The real issue is for older people where there is not much they can do, because if you’re past a certain age and you’re not in super, you can’t actually put the money in super so you can’t go into these options,” he said.

Retirement Planning

Majority of Australians still unsure about their retirement prospects

A recent survey conducted by MFS Investment Management® has shed light on the ongoing uncertainty faced by many Australians regarding their retirement plans. Despite a slight increase in confidence ...Read more

Retirement Planning

Wage growth steadies as businesses navigate economic challenges

In a sign that the Australian labour market may be finding equilibrium, wage growth has stabilised this quarter, according to Employment Hero's latest data. This development comes as employers ...Read more

Retirement Planning

Simplified retirement advice: Key to overcoming behavioural biases, experts say

In a bid to enhance retirement outcomes for Australians, a recent whitepaper by Industry Fund Services, in collaboration with Challenger, has highlighted the importance of simplifying retirement ...Read more

Retirement Planning

Rest launches Retire Ready digital experience to empower members approaching retirement

Rest, one of Australia’s largest profit-to-member superannuation funds, has unveiled a new digital experience aimed at making retirement preparation simpler and more personalised for its members. Read more

Retirement Planning

New Framework Aims to Bridge Australia’s Financial Advice Gap

A ground-breaking framework introduced by the Actuaries Institute promises to revolutionise how Australians access financial support, potentially transforming the financial wellbeing of millionsRead more

Retirement Planning

The downsizer dividend: how Australia’s ageing shift will reshape property, finance and AI strategy

Downsizing is moving from a personal milestone to a system-level lever for Australia’s housing market. As policymakers court reforms and agents eye fresh listings, the real profit pools will accrue to ...Read more

Retirement Planning

Half of Australians financially insecure about retirement as AMP launches new initiative

In a significant move aimed at addressing the retirement concerns of Australians, AMP has unveiled the Retirement Confidence Pulse, a national barometer designed to gauge the financial confidence of ...Read more

Retirement Planning

North introduces Grow to expand Australia's financial advice footprint

In a bid to bridge the gap between the demand for financial advice and its accessibility, North, a prominent platform for superannuation and retirement in Australia, has launched an innovative ...Read more

Retirement Planning

Majority of Australians still unsure about their retirement prospects

A recent survey conducted by MFS Investment Management® has shed light on the ongoing uncertainty faced by many Australians regarding their retirement plans. Despite a slight increase in confidence ...Read more

Retirement Planning

Wage growth steadies as businesses navigate economic challenges

In a sign that the Australian labour market may be finding equilibrium, wage growth has stabilised this quarter, according to Employment Hero's latest data. This development comes as employers ...Read more

Retirement Planning

Simplified retirement advice: Key to overcoming behavioural biases, experts say

In a bid to enhance retirement outcomes for Australians, a recent whitepaper by Industry Fund Services, in collaboration with Challenger, has highlighted the importance of simplifying retirement ...Read more

Retirement Planning

Rest launches Retire Ready digital experience to empower members approaching retirement

Rest, one of Australia’s largest profit-to-member superannuation funds, has unveiled a new digital experience aimed at making retirement preparation simpler and more personalised for its members. Read more

Retirement Planning

New Framework Aims to Bridge Australia’s Financial Advice Gap

A ground-breaking framework introduced by the Actuaries Institute promises to revolutionise how Australians access financial support, potentially transforming the financial wellbeing of millionsRead more

Retirement Planning

The downsizer dividend: how Australia’s ageing shift will reshape property, finance and AI strategy

Downsizing is moving from a personal milestone to a system-level lever for Australia’s housing market. As policymakers court reforms and agents eye fresh listings, the real profit pools will accrue to ...Read more

Retirement Planning

Half of Australians financially insecure about retirement as AMP launches new initiative

In a significant move aimed at addressing the retirement concerns of Australians, AMP has unveiled the Retirement Confidence Pulse, a national barometer designed to gauge the financial confidence of ...Read more

Retirement Planning

North introduces Grow to expand Australia's financial advice footprint

In a bid to bridge the gap between the demand for financial advice and its accessibility, North, a prominent platform for superannuation and retirement in Australia, has launched an innovative ...Read more