Resources

Gold 2019 outlook

Promoted by ETF Securities.

Gold 2019 outlook

Does it take a market correction to see the value in gold?

2018 wrapped up in a storm of volatility. Markets up for the first three quarters and down thereafter through to late December. Consequently, leaving investors wary of what may be on the horizon. Though we have entered a fresh year, many of these volatility drivers still exist as they remain unresolved.

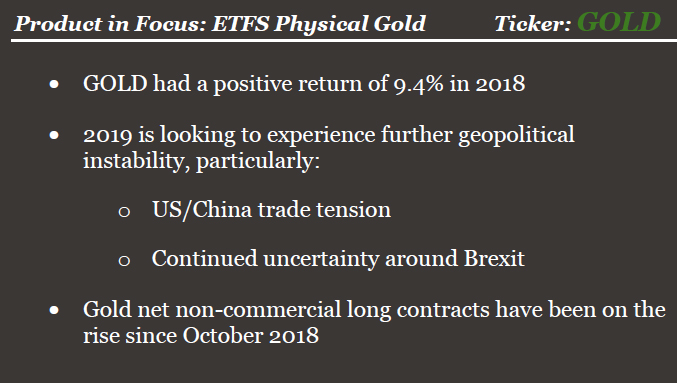

Looking at the geopolitical landscape, 2019 is likely to present events that will continue to affect market sentiment. Trade tensions between the US and China remain, Brexit is fast approaching the original deadline and elections are upcoming in India, the EU and Australia, with all expected to play a role in shaping the year ahead.

With this continued uncertainty, defensive strategies and diversification shall continue to be on the mind of many

How did gold weather the storm?

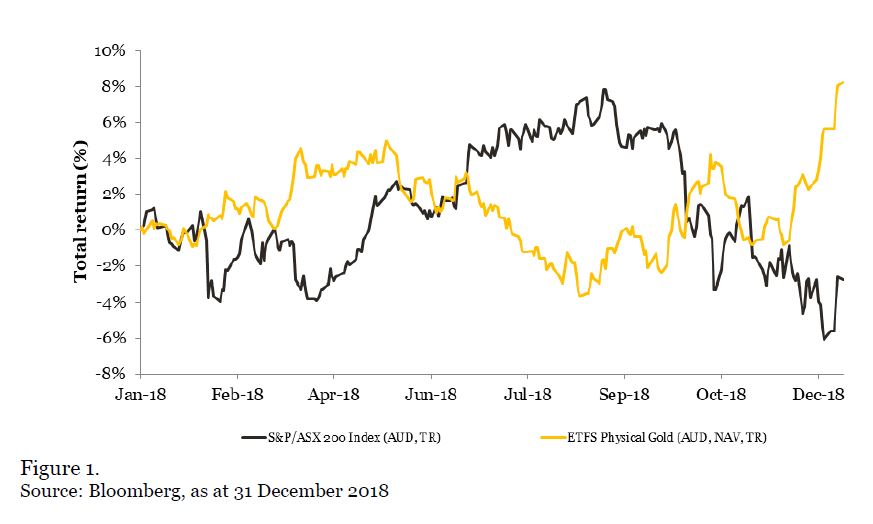

The tail of 2018 saw gold perform as a good hedge against equities. Whilst the S&P/ASX 200 dropped 7.8% from October to December end, gold netted a 9.6% gain in this same period (Figure 1), which indicates inclusion of gold into a portfolio for the period could have reduced volatility and downside risk.

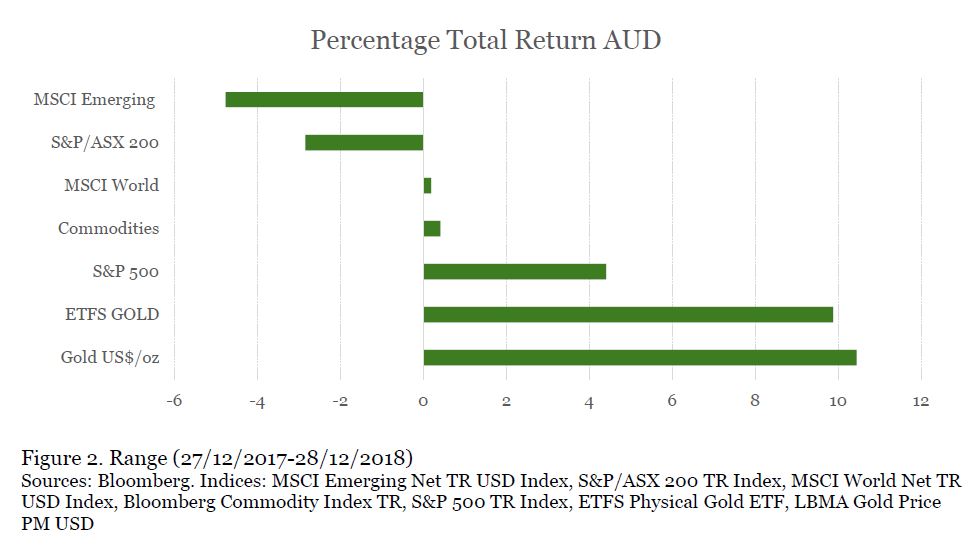

Examining several major indices across 2018, ETFS Physical GOLD had a positive return of 9.4% whilst all major equities were in the red (Figure 2).

Gold outlook for 2019

The outlook for 2019 performance will likely be impacted by a continuation of the global themes that dictated the close of 2018. In the World Gold Council’s “Outlook 2019: Economic trends and their impact on gold”, it has outlined three important drivers of gold demand: financial market instability, the impact of rates and the dollar and structural economic reforms.

The political instability that has enveloped the leading economies of the US and the UK is set to continue with markets responding to ongoing turmoil. The protectionist attitude of the US has encouraged inflation, with gold used by many to hedge against this. These movements have heralded a renewed interest in gold which can be seen on multiple fronts. Net positive flows into ETFs have occurred for the previous three months, though Asian markets (including Australia) have lagged Europe and America on this front.

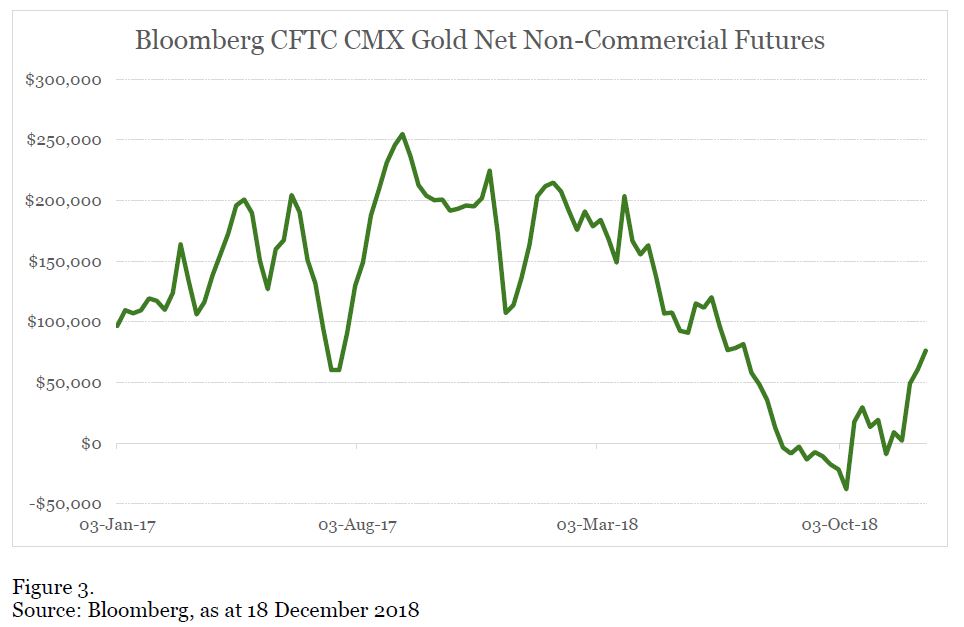

Futures have also pointed to change in sentiment towards gold. Net non-commercial long contracts have been on the rise since October 2018, reversing the downward trend seen throughout 2017 and most of 2018 (Figure 3).

The bearish view of gold suggests that performance could be constrained by a strong US dollar and rising interest rates. Addressing these points; the significant price movements of the dollar in recent weeks makes the price outlook of the dollar particularly tricky to predict. Examining the relationship between gold and interest rates, these have seen a degree of positive correlation in the past although not to a particularly significant degree.

Finally, economic reform is expected to continue across China and India in 2019. As the greatest consumers of physical gold (through both investment and jewellery), economic growth in these regions will likely impact the precious metal. Further economic development and particularly the increase of wealth in India and it’s growing middle class is likely to continue to drive demand.

On balance key indicators that have dictated the previous performance of gold suggest that we are likely to see a continuation in the upward trend of both investment flows and price of gold.

Investors wanting to access gold may be interested in the benefits of exposure through investing in gold miners’ equities. Whilst this strategy gives the potential to receive dividends it does not offer the same exposure of a physical gold ETF such as GOLD as the price changes in gold miners can be quite different from the movement of gold price.

The mining industry has recently garnered attention due to large M&A movements. Significantly Goldcorp will be acquired by Newmont Mining in a US$10bn deal. Subsequent to this announcement Newmont’s share price dropped 11% overnight.

For investors who are utilising gold as an event risk hedge, other factors such as M&A activity can have unexpected effects on gold miner’s share prices. Therefore, a direct exposure to physical gold will eliminate exposure to stock specific risks.

ETFS Physical Gold Factsheet

GET MORE INFORMATION

To sign up for future ETFS Trade ideas, email

|

Sales

|

Trading

|

|

Ganesh Balendran

|

Chad Hitzeman

|

|

Kanish Chugh

|

Gemma Weeks

|

|

Nicola Culey

|

Larry Achike

|

This document is communicated by ETFS Management (AUS) Limited (Australian Financial Services Licence Number 466778) (“ETFS”). This document may not be reproduced, distributed or published by any recipient for any purpose. Under no circumstances is this document to be used or considered as an offer to sell, or a solicitation of an offer to buy, any securities, investments or other financial instruments and any investments should only be made on the basis of the relevant product disclosure statement which should be considered by any potential investor including any risks identified therein.

This document does not take into account your personal needs and financial circumstances. You should seek independent financial, legal, tax and other relevant advice having regard to your particular circumstances. Although we use reasonable efforts to obtain reliable, comprehensive information, we make no representation and give no warranty that it is accurate or complete.

Investments in any product issued by ETFS are subject to investment risk, including possible delays in repayment and loss of income and principal invested. Neither ETFS, ETFS Capital Limited nor any other member of the ETFS Capital Group guarantees the performance of any products issued by ETFS or the repayment of capital or any particular rate of return therefrom.

The value or return of an investment will fluctuate and investor may lose some or all of their investment. Past performance is not an indication of future performance.

Sponsored features

Dissecting the Complexities of Cash Indices Regulations: An In-Depth Analysis

Introduction In recent years, the world of finance has seen a surge of interest in cash indices trading as investors seek potential returns in various markets. This development has brought increased ...Read more

Sponsored features

The Best Ways to Find the Right Trading Platform

Promoted by Animus Webs Read more

Sponsored features

How the increase in SMSF members benefits business owners

Promoted by ThinkTank Read more

Sponsored features

Thinktank’s evolution in residential lending and inaugural RMBS transaction

Promoted by Thinktank When Thinktank, a specialist commercial and residential property lender, recently closed its first residential mortgage-backed securitisation (RMBS) issue for $500 million, it ...Read more

Sponsored features

Investors tap into cyber space to grow their wealth

Promoted by Citi Group Combined, our daily spending adds up to opportunities for investors on a global scale. Read more

Sponsored features

Ecommerce boom as world adjusts to pandemic driven trends

Promoted by Citi Group COVID-19 has accelerated the use of technologies that help keep us connected, creating a virtual supply chain and expanded digital universe for investors. Read more

Sponsored features

Industrial property – the silver lining in the retail cloud

Promoted by ThinkTank Read more

Sponsored features

Why the non-bank sector appeals to SMSFs

Promoted by Think Tank Read more

Sponsored features

Dissecting the Complexities of Cash Indices Regulations: An In-Depth Analysis

Introduction In recent years, the world of finance has seen a surge of interest in cash indices trading as investors seek potential returns in various markets. This development has brought increased ...Read more

Sponsored features

The Best Ways to Find the Right Trading Platform

Promoted by Animus Webs Read more

Sponsored features

How the increase in SMSF members benefits business owners

Promoted by ThinkTank Read more

Sponsored features

Thinktank’s evolution in residential lending and inaugural RMBS transaction

Promoted by Thinktank When Thinktank, a specialist commercial and residential property lender, recently closed its first residential mortgage-backed securitisation (RMBS) issue for $500 million, it ...Read more

Sponsored features

Investors tap into cyber space to grow their wealth

Promoted by Citi Group Combined, our daily spending adds up to opportunities for investors on a global scale. Read more

Sponsored features

Ecommerce boom as world adjusts to pandemic driven trends

Promoted by Citi Group COVID-19 has accelerated the use of technologies that help keep us connected, creating a virtual supply chain and expanded digital universe for investors. Read more

Sponsored features

Industrial property – the silver lining in the retail cloud

Promoted by ThinkTank Read more

Sponsored features

Why the non-bank sector appeals to SMSFs

Promoted by Think Tank Read more