Revealed: The top 3 reasons Australians need life insurance

It’s life insurance awareness week, and so the Financial Services Council has taken the opportunity to highlight the most common causes of life insurance claims using KPMG analysis of Australian insurance data.

According to the Financial Services Council’s senior policy manager for life insurance, Nick Kirwan, new claims statistics tell us a lot about the difference between men and women.

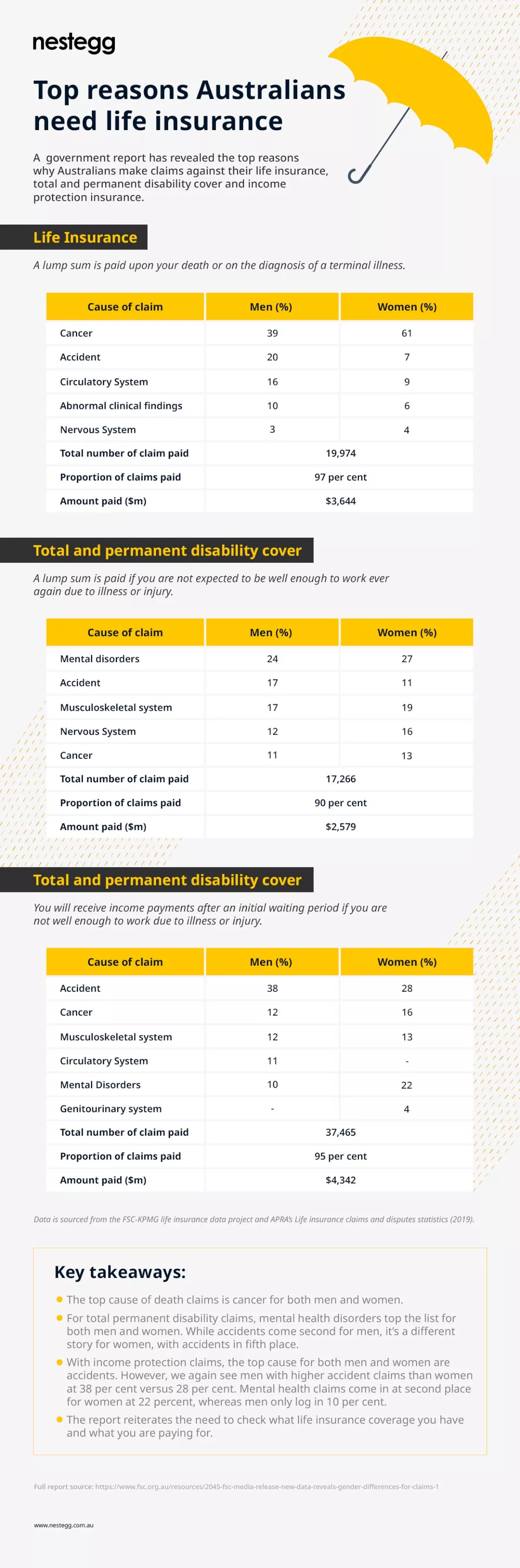

Life insurance:

Life insurance pays a lump sum on your death or the diagnosis of a terminal illness.

The top cause of death claims in Australia, according to the data, is cancer. This is true for both men and women – but the differences are still stark.

For men, it accounts for 39 per cent of all death claims.

For women – this figure is up at 61 per cent, of which 29 per cent relates to breast cancer. Colon cancer (15 per cent) and lung cancer (14 per cent) also make up high proportions.

For men, accidents are the second most common cause of death-related claims – at 20 per cent.

Circulatory system issues account for the third highest proportion of claims for men – at 16 per cent, while this is the second most common cause of death claim for women, at 9 per cent of all life insurance claims.

For women, accidents come in third place – at just 7 per cent of all claims.

TPD insurance:

Total and permanent disability (TPD) insurance pays out a lump sum to individuals who are not expected to be well enough to work ever again due to illness or injury.

For both men and women, mental disorders accounted for the highest proportion of claims.

For men, just under one-quarter (24 per cent) were attributable to mental health, while it was slightly higher for women, at 27 per cent.

Accidents were again ranked in second for men, this time tying with issues of the musculoskeletal system at 17 per cent of all TPD cases apiece.

For women, musculoskeletal system issues (19 per cent) just beat out issues of the nervous system, which was the third most claimed against concern – at 16 per cent.

Income protection:

Income protection insurance pays an individual an income after an initial waiting period if that person is not well enough to work due to illness or injury.

Proving accidents are very worthy of insurance protection, the category this time topped the proportion of claims for both men (38 per cent) and women (28 per cent).

Cancer and musculoskeletal system claims were tied in second place for claims by men (12 per cent each), while for women, 22 per cent of income protection claims related to mental disorders and a further 16 per cent related to cancer.

Commenting on the data, Mr Kirwan said the data “confirms that for working age Australians, cancer is by far the biggest killer and it’s even more deadly for women than for men”.

“We see that men have significantly more accidents than women, and women more mental health claims.”

The senior policy manager is encouraging all Australians to check on what life insurance cover they have: “Be aware of what you have and what you’re paying for.”

“Give your superannuation trustee or life insurance company a call today so you and your family are secure no matter what happens,” he concluded.

About the author

About the author

Insurance

Australians prioritise life insurance over luxuries amid cost-of-living pressures

Australians are choosing to maintain life insurance and income protection policies over discretionary spending including gym memberships, holidays and mobile phone upgrades, new research has found. ...Read more

Insurance

Aussie property owners teeter on financial ruin as underinsurance crisis escalates

According to industry-first data compiled by leading insurance expert MCG Quantity Surveyors, Australian property owners are facing a dire underinsurance crisis, with many just one insurance event awa...Read more

Insurance

Insurers ramp up concerns over greenwashing amid stricter ESG standards

A recent global study has shed light on the growing apprehensions within the insurance industry regarding greenwashing, as environmental, social, and governance (ESG) criteria become more rigorous. ...Read more

Insurance

Ortec Finance study highlights insurers' readiness to tackle increased investment risks amidst growing concerns

A new study conducted by Ortec Finance, a premier provider of risk and return management solutions for the financial sector, indicates a notable shift in the risk-taking attitude among insurers regard...Read more

Insurance

Climate disasters leave 1 in 25 properties uninsurable by 2030

Climate change-induced disasters and mounting risks of dangerous weather will make one in 25 Australian properties “effectively uninsurable” by 2030, according to a damning new report from Austral...Read more

Insurance

Insurers running for cover from accusation of “failing consumers”

As insurance providers have recently been inundated with a large volume of claims for damages from yet another set of so-called “once-in-a-hundred-years” floods, the embattled sector is now coming...Read more

Insurance

Class action over add-on insurance commences in court

Allianz has been accused of engaging in misleading or deceptive conduct. ...Read more

Insurance

Saving money on insurance means asking the right questions

There are plenty of must-do’s and missteps that those looking to buy home and contents insurance need to stay on top of. ...Read more

Insurance

Australians prioritise life insurance over luxuries amid cost-of-living pressures

Australians are choosing to maintain life insurance and income protection policies over discretionary spending including gym memberships, holidays and mobile phone upgrades, new research has found. ...Read more

Insurance

Aussie property owners teeter on financial ruin as underinsurance crisis escalates

According to industry-first data compiled by leading insurance expert MCG Quantity Surveyors, Australian property owners are facing a dire underinsurance crisis, with many just one insurance event awa...Read more

Insurance

Insurers ramp up concerns over greenwashing amid stricter ESG standards

A recent global study has shed light on the growing apprehensions within the insurance industry regarding greenwashing, as environmental, social, and governance (ESG) criteria become more rigorous. ...Read more

Insurance

Ortec Finance study highlights insurers' readiness to tackle increased investment risks amidst growing concerns

A new study conducted by Ortec Finance, a premier provider of risk and return management solutions for the financial sector, indicates a notable shift in the risk-taking attitude among insurers regard...Read more

Insurance

Climate disasters leave 1 in 25 properties uninsurable by 2030

Climate change-induced disasters and mounting risks of dangerous weather will make one in 25 Australian properties “effectively uninsurable” by 2030, according to a damning new report from Austral...Read more

Insurance

Insurers running for cover from accusation of “failing consumers”

As insurance providers have recently been inundated with a large volume of claims for damages from yet another set of so-called “once-in-a-hundred-years” floods, the embattled sector is now coming...Read more

Insurance

Class action over add-on insurance commences in court

Allianz has been accused of engaging in misleading or deceptive conduct. ...Read more

Insurance

Saving money on insurance means asking the right questions

There are plenty of must-do’s and missteps that those looking to buy home and contents insurance need to stay on top of. ...Read more