Save

Investors deserve clarity on negative gearing, lobby group says

A prominent investor lobby group has taken aim at federal Labor for keeping the Australian public “in the dark” on when it will implement its policy to amend negative gearing.

Investors deserve clarity on negative gearing, lobby group says

A prominent investor lobby group has taken aim at federal Labor for keeping the Australian public “in the dark” on when it will implement its policy to amend negative gearing.

Ben Kingsley, chairman of the Property Investors Council of Australia, said that the current lack of clarity as to whether a Labor-led government would proceed with its proposed changes to negative gearing is harming already dwindling housing markets.

“Restricting negative gearing to new property was always a ridiculous so-called ‘solution’ to Sydney’s strong price growth, which has now well and truly dissipated because it was merely a sign of the peak of a market cycle,” Mr Kingsley said.

“If the policy was absurd back then, it’s even more so now, with the national economy flatlining due to a number of poor indicators, including significant property price falls, in our two biggest cities.

“Labor supposedly represents everyday Australians, yet the policy is likely to see the wealth of their constituents nosedive even more because of the negative impact it will have on the market.”

Mr Kingsley said that it was fundamental for national Labor to “come clean” on when the policy changes will come into effect, if at all, to ensure Australians are adequately prepared for the impact on their wealth.

“The majority of every Australian’s wealth is in their property, so having the threat of their home’s value falling even further is no doubt part of the reason why our economy is in the doldrums,” he said.

“It’s clear that people are fearful about these dangerous changes — both property owners and investors alike — so if federal Labor is thinking about introducing these measures as early as July this year, buyers need to have enough time to organise their finances and come to the market in the next few months to meet this deadline.

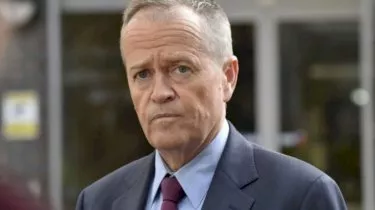

“With Labor tipped to win the federal election, the uncertainty is affecting the Australian property market and the broader economy, which is why Bill Shorten should announce the party’s intentions today. There is no reason not to tell us their plans as the policy was formulated years ago.”

Mr Kingsley’s words mirror those issued by the Real Estate Institute of Australia’s president, Adrian Kelly, earlier this week.

“All Australians need to know what and when a Labor government, if elected, will do regarding property taxation,” Mr Kelly said in a statement.

“It is not acceptable to appear to be ‘having a bob each way’ in the lead-up to the election.”

Mr Kelly said that it is imperative that the Labor government detail clearly their approach to taxation ahead of the election so that the Australian public can vote accordingly.

“Let’s look at all property taxes in a holistic approach and not just negative gearing and capital gains tax as if that’s the panacea to housing affordability,” Mr Kelly said.

“There is already enough market uncertainty particularly in the larger states and a ‘nothing to see here’ approach will only exacerbate this uncertainty.

“The ALP needs to come clean with what its election policies actually are so that all Australians… know exactly what they will be voting for and can make an informed decision at the ballot box.”

Tax saving

$20,000 instant asset write-off extension welcomed, but calls for broader support grow

The Australian government's decision to extend the $20,000 instant asset write-off into the next financial year has been met with approval from business leaders. However, there are growing calls for ...Read more

Tax saving

The downsizer dividend: How targeted tax levers could unlock housing supply in Australia

A call by Raine & Horne to incentivise seniors to move to smaller homes has kicked off a wider policy conversation that reaches well beyond real estate. If designed well, a targeted package could ...Read more

Tax saving

Raine & Horne's bold move could unlock housing supply but what are the hidden risks

Raine & Horne’s call for targeted tax incentives to encourage empty nesters to ‘rightsize’ isn’t just another sector wish list; it’s a potential lever to free up family homes, ease rental ...Read more

Tax saving

From annual check-ups to always‑on: how modern portfolio reviews unlock after‑tax alpha

The era of once‑a‑year portfolio check‑ins is over. Continuous, tech‑enabled reviews now drive returns through tax efficiency, risk control and behavioural discipline—especially in a high‑rate ...Read more

Tax saving

Navigating tax laws for capital gains in 2023

The landscape of Australian tax laws surrounding capital gains is ever-changing, with 2023 being no exception. Read more

Tax saving

What you need to know about the tax implications of crypto

One million Aussies are now invested in crypto, but many have not thought about how these investments will affect them at tax time. Read more

Tax saving

Welfare overhaul could give recipients a leg-up

Australia’s Centrelink recipients who’ve been doing it tough are in for a potentially easier time if the federal government pursues ambitious reforms that could provide sturdier safety nets. Read more

Tax saving

Students should think twice before tapping into their super

Former students might want to think carefully before they look to take advantage of the federal government’s biggest first home buyer incentive. Read more

Tax saving

$20,000 instant asset write-off extension welcomed, but calls for broader support grow

The Australian government's decision to extend the $20,000 instant asset write-off into the next financial year has been met with approval from business leaders. However, there are growing calls for ...Read more

Tax saving

The downsizer dividend: How targeted tax levers could unlock housing supply in Australia

A call by Raine & Horne to incentivise seniors to move to smaller homes has kicked off a wider policy conversation that reaches well beyond real estate. If designed well, a targeted package could ...Read more

Tax saving

Raine & Horne's bold move could unlock housing supply but what are the hidden risks

Raine & Horne’s call for targeted tax incentives to encourage empty nesters to ‘rightsize’ isn’t just another sector wish list; it’s a potential lever to free up family homes, ease rental ...Read more

Tax saving

From annual check-ups to always‑on: how modern portfolio reviews unlock after‑tax alpha

The era of once‑a‑year portfolio check‑ins is over. Continuous, tech‑enabled reviews now drive returns through tax efficiency, risk control and behavioural discipline—especially in a high‑rate ...Read more

Tax saving

Navigating tax laws for capital gains in 2023

The landscape of Australian tax laws surrounding capital gains is ever-changing, with 2023 being no exception. Read more

Tax saving

What you need to know about the tax implications of crypto

One million Aussies are now invested in crypto, but many have not thought about how these investments will affect them at tax time. Read more

Tax saving

Welfare overhaul could give recipients a leg-up

Australia’s Centrelink recipients who’ve been doing it tough are in for a potentially easier time if the federal government pursues ambitious reforms that could provide sturdier safety nets. Read more

Tax saving

Students should think twice before tapping into their super

Former students might want to think carefully before they look to take advantage of the federal government’s biggest first home buyer incentive. Read more