Invest

What is Wealthy in Australia?

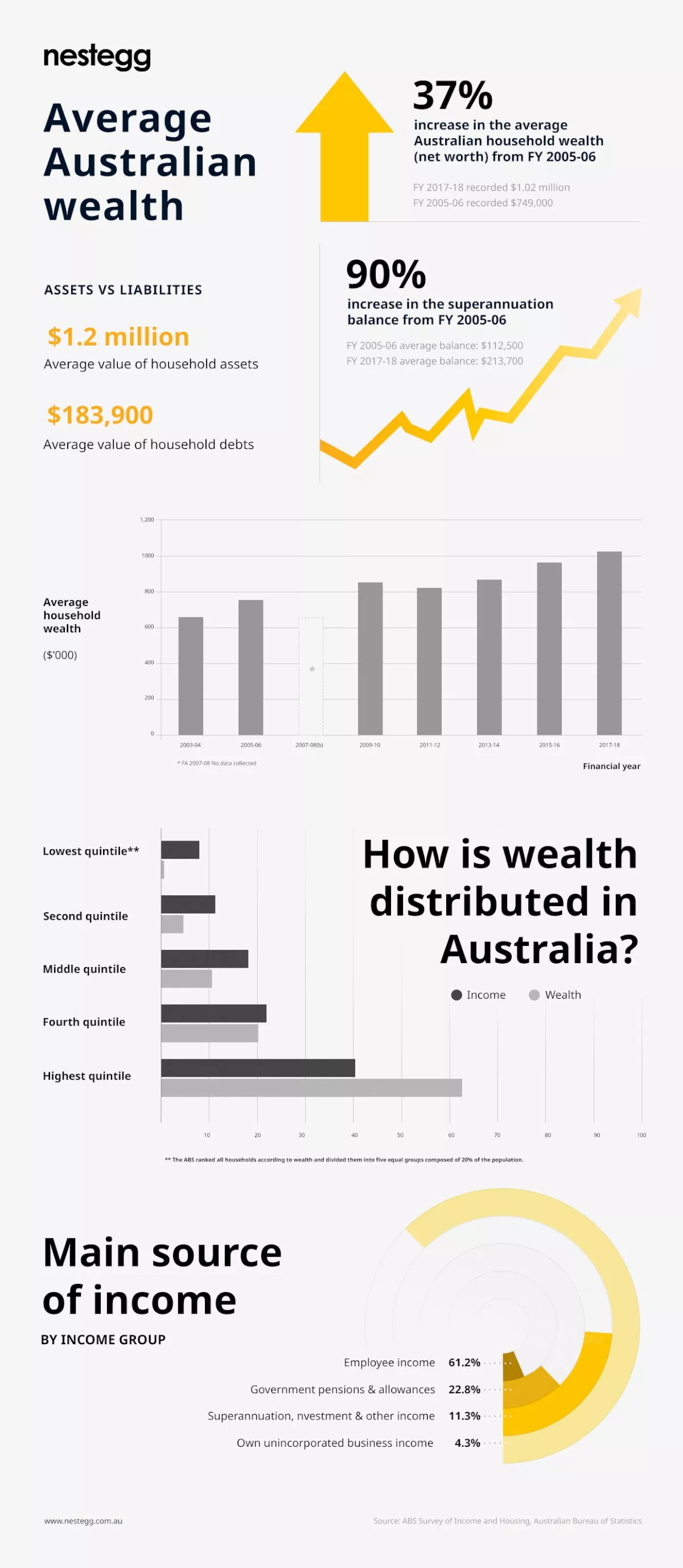

According to ABS figures released in 2019, the average wealth of Australian households saw a 37 per cent increase in the 12-year period ending FY 2017-18.

What is Wealthy in Australia?

According to ABS figures released in 2019, the average wealth of Australian households saw a 37 per cent increase in the 12-year period ending FY 2017-18.

ABS statistics show that the average wealth of Australian households amounted to $749,000 In FY 2005-06 whereas FY2017-18 recorded an average of $1.02 million.

In the same period, superannuation balances saw a 90 per cent increase from $112,500 to $213,700. These figures may indicate that Aussies have gotten better at planning their financial independence in retirement.

However, the recent statistics also reveal that the huge divide on wealth control between the wealthiest and least wealthy. In fact, The wealthiest 20 per cent held 63.4 per cent of Australia’s total household wealth whereas the least wealthy 18 per cent held only 0.7 per cent.

The middle 60 per cent shared in 36 per cent of total household wealth. Despite this, many still believe they are part of the middle class.

“It’s amazing how many people think they’re middle class.”

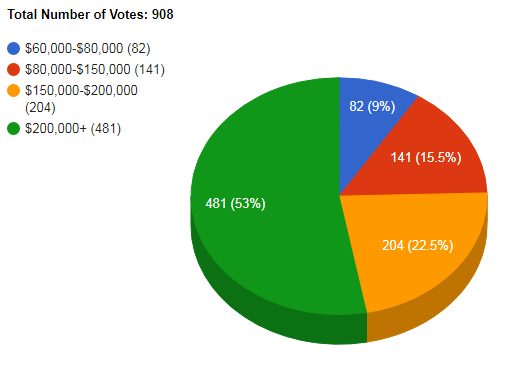

A few months ago, Nest Egg ran a poll asking readers how much taxable income you need to be considered wealthy.

It threw up some interesting numbers. Nearly 10 per cent of readers think you’re wealthy if you’re earning between $60,000 and $80,000.

Another 15.6 per cent think you’re well-off if you’re earning between $80,000 and $150,000, while a further 22.4 per cent of readers think you’re wealthy if you’re earning between $150,000 and $200,000.

Then there’s this. Most readers, 53 per cent, think you’re not wealthy until you’re earning $200,000 a year.

However, the average salary for a full-time worker is $1,597.90 a week, as of November 2017. That’s an annual income of $81,530.80, and Australia is considered a pretty wealthy country.

That’s before we factor in household wealth, which really complicates the picture.

It’s also before we consider the wealth that comes with living in a country with public health care, education, infrastructure and opportunities.

It’s a tricky question, so we also asked the experts.

Saul Eslake, independent economist –

To be a wealthy Australian is to have both a solid income and wealth

“There's a difference between income and wealth. So, wealth is your balance sheet, how much in assets you own and what you owe, if anything, on those assets,” Mr Eslake said.

“There are quite a lot of old folks around who are wealthy in the sense that they might own a home in what is now an expensive suburb, and they don't have any mortgage on it so they're wealthy. But, if they're on the age pension, it's not necessarily clear that they're rich.”

According to figures from the Australian Bureau of Statistics, the top 20 per cent of income earners in 2015-16 were earning around $110,000 a year before tax. The top 10 per cent of wealth-holders hold $1.2 million.

“So someone to be considered rich, I'd say someone would need to have to be in the top tax bracket, which would mean a taxable income of over $180,000. And, maybe $1 million or more of net worth,” Mr Eslake said.

“And even then you might say that could be excluding your principle residence.”

However, he noted that most Australians don’t consider themselves to be wealthy.

“It's amazing how many people think they're middle class,” Mr Eslake said.

Bernard Salt, demographer and commentator –

Wealth is having the funds to support your lifestyle, but societal lifestyle expectations affect this

“The reality is that you can be a hermit living up in the Daintree and not give your financial situation concern, but I think that its more practically just having enough to live the kind of lifestyle that you want. So everyone can be wealthy if they just tailor their aspirations in life in that regard,” Mr Salt said.

“But I do think it's a trade-off between how you expect to live. The problem with that is that is changing. It is rising. This idea of a caravan holiday to Coolangatta, which was actually quite aspirational and a sort of, almost like a show off thing to do back in the 1950s, is a bit embarrassing today.”

Liz Moran, FIIG –

Wealth is freedom, but not everyone knows they’re wealthy

“It's freedom to do what you want to do, to have choice in how you spend. And it's having that security of either the assets behind you, or you're comfortable in your position. To me, you don't have to own your own house. If you have freedom and choice and you can go and have that smashed avocado on toast and have a holiday to Fiji or put your kids in private school, I think that's wealthy. I think all those things are wealthy,” Ms Moran said.

“I think a lot of Australians are wealthy, but they don't recognise it. And I should say I always think being wealthy is having your health, and we have a good health system. Nothing else matters if you don’t.”

Brendan Coates, Grattan Institute –

Wealth can be influenced by when you were born and, in the future, your parents

“Australia has become a really wealthy country and that wealth is being pretty broadly distributed. So, if you bought a home 30 years ago today, or even 20 or 15 ago, you would've done exceptionally well over the last couple decades,” Mr Coates said.

“[However,] what we've seen is a widening in wealth and equality across generations,” he said, pointing to the changing housing market and the lower rates of younger homeowners.

“The issue is that in time, that'll translate into a shift from intergenerational wealth inequality to intragenerational wealth inequality, so whether you own a house will depend much more on whether your parents owned one. And your wealth as a 50-year-old will depend much more on the wealth that your parents passed on to you than what you've earned and saved and invested over your life.

“The real challenge that we sort of grapple with as a society is that a housing market and record low interest rates delivered enormous windfall gain for some Australians, and not others; that wealth level and income will become over time a much more important determiner of social class and how well-off we feel.”

Stephen Koukoulas, Market Economics –

Political discourse is part of the problem

While his definition of wealthy is being able to comfortably pay the bills and lead the lifestyle you want, Mr Koukoulas believes the current political discourse tends to “pick on people’s vulnerabilities” and suggests that the cost of living is terrible.

The current energy price debate is a good example.

“The thing that interests me about electricity bills is that the average household will spend three times more on takeaway food and alcoholic drinks than we do on electricity. Just that we get an electricity bill once a quarter, it's a big ticket item,” Mr Koukoulas said.

When it comes to health care, life expectancy, living standards and education, we’re doing quite well.

“But it's very hard for a politician to say. I think John Howard once said, 'You've never had it so good'. And the funny thing is he was right, but he just got shot down politically for saying it,” Mr Koukoulas said.

Spending

Household Spending Pops, Rate Hike Looms: A CFO Playbook from an Australian Retail Case

Fresh ABS data shows household outlays running hotter than expected, particularly in services—stoking calls for an RBA move as early as February. For operators, the macro headline is simple; the man...Read more

Spending

State Street economist comments on softer-than-expected CPI data

In light of the latest Consumer Price Index (CPI) data release, Krishna Bhimavarapu, APAC Economist at State Street Investment Management, has provided insight into the implications for the Australian...Read more

Spending

Moneysmart study reveals Gen Z women more concerned about finances than men

A new research conducted by ASIC’s Moneysmart has unveiled the heightened levels of stress and concern regarding finances and the cost of living among Australian Gen Z women compared to their male c...Read more

Spending

The cost of politeness: Aussies out of pocket by $1,350 due to 'awkward tax'

It's the time of year when Australians dive into their pockets for festive events and gatherings, yet a recent study by PayPal suggests that many are too polite, or perhaps too embarrassed, to ask for...Read more

Spending

Aussies can ‘NAB Now Pay Later’ with the last major bank to embrace BNPL

NAB has become the latest bank to enter the BNPL market. ...Read more

Spending

Aussie households spent $368 a week on transport after petrol price surge

Fuel costs have increased by 40 per cent over the past year, a new report from the Australian Automobile Association has revealed. ...Read more

Spending

Voters say reducing the cost of living should be the government’s top priority

Aussies have ranked high cost of living as the top issue that needs to be addressed by the next government. ...Read more

Spending

Bodies back Labor’s commitment to stronger BNPL regulation

All parties should commit to stronger regulations for the BNPL sector, according to Financial Counselling Australia. ...Read more

Spending

Household Spending Pops, Rate Hike Looms: A CFO Playbook from an Australian Retail Case

Fresh ABS data shows household outlays running hotter than expected, particularly in services—stoking calls for an RBA move as early as February. For operators, the macro headline is simple; the man...Read more

Spending

State Street economist comments on softer-than-expected CPI data

In light of the latest Consumer Price Index (CPI) data release, Krishna Bhimavarapu, APAC Economist at State Street Investment Management, has provided insight into the implications for the Australian...Read more

Spending

Moneysmart study reveals Gen Z women more concerned about finances than men

A new research conducted by ASIC’s Moneysmart has unveiled the heightened levels of stress and concern regarding finances and the cost of living among Australian Gen Z women compared to their male c...Read more

Spending

The cost of politeness: Aussies out of pocket by $1,350 due to 'awkward tax'

It's the time of year when Australians dive into their pockets for festive events and gatherings, yet a recent study by PayPal suggests that many are too polite, or perhaps too embarrassed, to ask for...Read more

Spending

Aussies can ‘NAB Now Pay Later’ with the last major bank to embrace BNPL

NAB has become the latest bank to enter the BNPL market. ...Read more

Spending

Aussie households spent $368 a week on transport after petrol price surge

Fuel costs have increased by 40 per cent over the past year, a new report from the Australian Automobile Association has revealed. ...Read more

Spending

Voters say reducing the cost of living should be the government’s top priority

Aussies have ranked high cost of living as the top issue that needs to be addressed by the next government. ...Read more

Spending

Bodies back Labor’s commitment to stronger BNPL regulation

All parties should commit to stronger regulations for the BNPL sector, according to Financial Counselling Australia. ...Read more