Invest

Why is Sydney a popular place to live in?

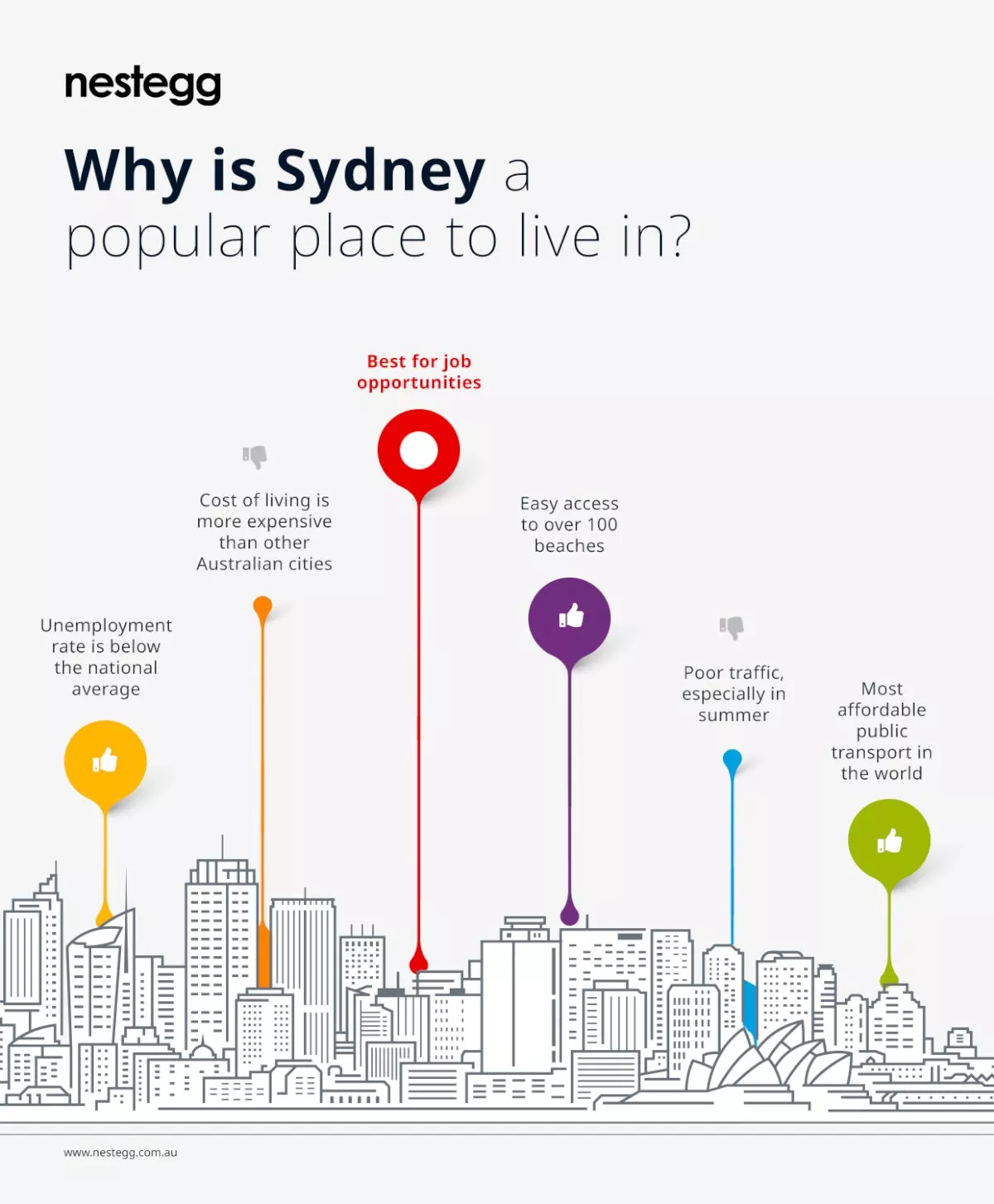

INFOGRAPHIC: There’s no denying that Sydney is home to one of the most picturesque harbours in the world. In fact, millions of tourists find their way to the Sydney Harbour and the Sydney Opera House each year to enjoy the view and culturally diverse activities.

Why is Sydney a popular place to live in?

INFOGRAPHIC: There’s no denying that Sydney is home to one of the most picturesque harbours in the world. In fact, millions of tourists find their way to the Sydney Harbour and the Sydney Opera House each year to enjoy the view and culturally diverse activities.

But Sydney isn’t only popular for its beauty — the sprawling state capital of NSW boasts great things when it comes to improving its population’s livelihood.

Here are some of the reasons that has allowed Sydney to maintain its status as one of the best cities in the world to live in.

Affordable public transport

According to the Australian Bureau of Statistics (ABS), Sydney is Australia’s most populated city, with an estimated population density of 400 people per square kilometre.

Naturally, moving this large population around is crucial to keeping the city’s economy thriving – and this is where Sydney’s comprehensive public transport network comes in.

Sydney’s public transport in the world is among the most affordable in the world.

Poor traffic

The downside for Sydneysiders is that the city usually suffers from poor traffic, with volumes typically reaching its peak during the summer season.

Low unemployment rate

According to the ABS labour force survey and Centrelink data, Sydney’s unemployment rate is at 2.46 per cent for the March 2019 quarter. This is well below the national average, which is at 5.1 per cent.

The 2019 census reveals that among the 171,427 local resident workers, 47.8 per cent are professionals and managerial-level workers. The remaining 52 per cent include clerical, administrative, community and personal service, sales, technicians trade and other skilled labourers.

Best for job opportunities

Sydney’s low unemployment rate is most likely influenced by the host of job opportunities that workers may choose from – and it’s not just Sydneysiders. The city’s sprawling economy paves the way for businesses to succeed and expand and opens more employment opportunities for Sydneysiders and migrants.

High cost of living

Sydney’s sprawling economy also has its downsides, particularly in the cost of living.

Despite high income-earning opportunities, Sydney’s cost of living is one of the highest among other Australian cities – and it doesn’t help that property values are just as high.

Best for beach lovers

When it comes to leisure activities, especially of the beach variety, Sydneysiders have easy access to over 100 beaches.

About the author

About the author

Property

From intuition to instrumentation: How a "two-stakeholder" sales playbook lifted close rates and cut cycle times

High-stakes consumer purchases are increasingly joint decisions. When one partner is under-served, deals stall. This case study follows an Australian real estate group that rebuilt its sales motion ar...Read more

Property

Selling in 2025: How to spot bad agents fast—and build an ROI-first vendor playbook

In Australia’s property market, choosing the wrong listing agent isn’t just inconvenient—it’s a textbook principal–agent failure that can wipe tens of thousands off your sale outcome. The re...Read more

Property

Selling in 2026: How to de‑risk your agent choice and protect tens of thousands at settlement

Choosing the wrong selling agent isn’t just an inconvenience — it’s a balance‑sheet risk. In a market where digital discovery is concentrated and AI is recasting how listings are priced and pr...Read more

Property

Rate resilience in Australian housing: why scarce supply is overpowering monetary tightening

Australia’s housing market is defying higher borrowing costs because the binding constraint isn’t demand—it’s supply. Brokers report persistent buyer competition and investor repositioning, wh...Read more

Property

Victoria’s $100m renter support push: what it means for landlords, proptech and the housing economy

Victoria has unveiled a new suite of rental support services, including a dedicated helpline for renters aged 55+, underpinned by a funding package widely reported at around $100 million. Beyond consu...Read more

Property

The multigenerational home moves mainstream: where the next margin lives in Australian real estate

Multigenerational living is shifting from edge case to core demand driver in Australia’s housing market. For agents, developers and lenders, the commercial upside lies in rethinking product design, ...Read more

Property

Multigenerational living is moving mainstream: how agents, developers and lenders can monetise the shift

Australia’s quiet housing revolution is no longer a niche lifestyle choice; it’s a structural shift in demand that will reward property businesses prepared to redesign product, pricing and go‑to...Read more

Property

Prestige property, precision choice: a case study in selecting the right agent when millions are at stake

In Australia’s top-tier housing market, the wrong agent choice can quietly erase six figures from a sale. Privacy protocols, discreet buyer networks and data-savvy marketing have become the new curr...Read more

Property

From intuition to instrumentation: How a "two-stakeholder" sales playbook lifted close rates and cut cycle times

High-stakes consumer purchases are increasingly joint decisions. When one partner is under-served, deals stall. This case study follows an Australian real estate group that rebuilt its sales motion ar...Read more

Property

Selling in 2025: How to spot bad agents fast—and build an ROI-first vendor playbook

In Australia’s property market, choosing the wrong listing agent isn’t just inconvenient—it’s a textbook principal–agent failure that can wipe tens of thousands off your sale outcome. The re...Read more

Property

Selling in 2026: How to de‑risk your agent choice and protect tens of thousands at settlement

Choosing the wrong selling agent isn’t just an inconvenience — it’s a balance‑sheet risk. In a market where digital discovery is concentrated and AI is recasting how listings are priced and pr...Read more

Property

Rate resilience in Australian housing: why scarce supply is overpowering monetary tightening

Australia’s housing market is defying higher borrowing costs because the binding constraint isn’t demand—it’s supply. Brokers report persistent buyer competition and investor repositioning, wh...Read more

Property

Victoria’s $100m renter support push: what it means for landlords, proptech and the housing economy

Victoria has unveiled a new suite of rental support services, including a dedicated helpline for renters aged 55+, underpinned by a funding package widely reported at around $100 million. Beyond consu...Read more

Property

The multigenerational home moves mainstream: where the next margin lives in Australian real estate

Multigenerational living is shifting from edge case to core demand driver in Australia’s housing market. For agents, developers and lenders, the commercial upside lies in rethinking product design, ...Read more

Property

Multigenerational living is moving mainstream: how agents, developers and lenders can monetise the shift

Australia’s quiet housing revolution is no longer a niche lifestyle choice; it’s a structural shift in demand that will reward property businesses prepared to redesign product, pricing and go‑to...Read more

Property

Prestige property, precision choice: a case study in selecting the right agent when millions are at stake

In Australia’s top-tier housing market, the wrong agent choice can quietly erase six figures from a sale. Privacy protocols, discreet buyer networks and data-savvy marketing have become the new curr...Read more