Invest

Investors urged to speak out against inequality

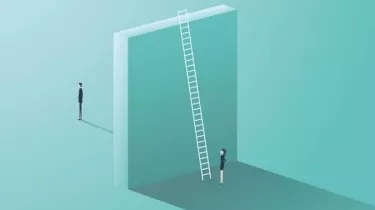

Shareholders have been urged to push back against gender equality laggards and consider exiting business relationships where inequality is ignored.

Investors urged to speak out against inequality

Shareholders have been urged to push back against gender equality laggards and consider exiting business relationships where inequality is ignored.

With a gender pay gap of 15.3 per cent and a superannuation gap of 47 per cent, according to the Workplace Gender Equality Agency, it’s time for shareholders to step up in reducing gender inequality, a new report has found.

The Australasian Centre for Corporate Responsibility’s (ACCR) Gender Pay Equity and Australian Listed Companies report found that while 80 per cent of listed companies have taken action as a result of gender pay gap analysis, only 24 per cent of the ASX 100-listed companies have made a public commitment to gender pay equity.

“Research suggests that companies that have gender pay equity are more likely to outperform their peers,” the report’s authors said.

“Therefore, it is in Australian companies’ interests to be at the forefront of addressing gender pay equity issues within their operations. It is also in investors’ interests to play a role in monitoring and enforcing gender pay equity.”

ACCR, in conjunction with responsible corporate analysis group CAER, called on investors to take five steps:

- Encourage companies to include gender pay equity issues into investment due diligence, screening, engagement and monitoring processes;

- Where possible, publish information about their engagement with companies on gender pay issues, like voting records on these issues;

- Think about saying goodbye to business relationships where the companies are not only failing to address gender pay issues, but are also not responding to engagement;

- For super funds, pushes to close the super gap should be backed up by shareholder advocacy; and

- Investors should push companies to adopt the recommendations made in the report for ASX-listed companies.

These targets include transparency with staff around pay, annual gender pay analyses, public commitments and tangible action during the employment process.

“The United States has taken the lead with regards to investor action to address gender pay equity issues through devices such as shareholder resolutions,” the authors said.

“Australian investors should take heed to these movements, and seek to ensure that Australian companies are adequately addressing gender pay equity issues within their own operations, as failure to do so can lead to litigation, reputational and operational risk.”

Property

Multigenerational living is moving mainstream: how agents, developers and lenders can monetise the shift

Australia’s quiet housing revolution is no longer a niche lifestyle choice; it’s a structural shift in demand that will reward property businesses prepared to redesign product, pricing and ...Read more

Property

Prestige property, precision choice: a case study in selecting the right agent when millions are at stake

In Australia’s top-tier housing market, the wrong agent choice can quietly erase six figures from a sale. Privacy protocols, discreet buyer networks and data-savvy marketing have become the new ...Read more

Property

From ‘ugly’ to alpha: Turning outdated Australian homes into high‑yield assets

In a tight listings market, outdated properties aren’t dead weight—they’re mispriced optionality. Agencies and vendors that industrialise light‑touch refurbishment, behavioural marketing and ...Read more

Property

The 2026 Investor Playbook: Rental Tailwinds, City Divergence and the Tech-Led Operations Advantage

Rental income looks set to do the heavy lifting for investors in 2026, but not every capital city will move in lockstep. Industry veteran John McGrath tips a stronger rental year and a Melbourne ...Read more

Property

Prestige property, precision choice: Data, discretion and regulation now decide million‑dollar outcomes

In Australia’s prestige housing market, the selling agent is no longer a mere intermediary but a strategic supplier whose choices can shift outcomes by seven figures. The differentiators are no longer ...Read more

Property

The new battleground in housing: how first-home buyer policy is reshaping Australia’s entry-level market

Government-backed guarantees and stamp duty concessions have pushed fresh demand into the bottom of Australia’s price ladder, lifting values and compressing selling times in entry-level segmentsRead more

Property

Property 2026: Why measured moves will beat the market

In 2026, Australian property success will be won by investors who privilege resilience over velocity. The market is fragmenting by suburb and asset type, financing conditions remain tight, and ...Read more

Property

Entry-level property is winning: How first home buyer programs are reshaping demand, pricing power and strategy

Lower-priced homes are appreciating faster as government support channels demand into the entry tier. For developers, lenders and marketers, this is not a blip—it’s a structural reweighting of demand ...Read more

Property

Multigenerational living is moving mainstream: how agents, developers and lenders can monetise the shift

Australia’s quiet housing revolution is no longer a niche lifestyle choice; it’s a structural shift in demand that will reward property businesses prepared to redesign product, pricing and ...Read more

Property

Prestige property, precision choice: a case study in selecting the right agent when millions are at stake

In Australia’s top-tier housing market, the wrong agent choice can quietly erase six figures from a sale. Privacy protocols, discreet buyer networks and data-savvy marketing have become the new ...Read more

Property

From ‘ugly’ to alpha: Turning outdated Australian homes into high‑yield assets

In a tight listings market, outdated properties aren’t dead weight—they’re mispriced optionality. Agencies and vendors that industrialise light‑touch refurbishment, behavioural marketing and ...Read more

Property

The 2026 Investor Playbook: Rental Tailwinds, City Divergence and the Tech-Led Operations Advantage

Rental income looks set to do the heavy lifting for investors in 2026, but not every capital city will move in lockstep. Industry veteran John McGrath tips a stronger rental year and a Melbourne ...Read more

Property

Prestige property, precision choice: Data, discretion and regulation now decide million‑dollar outcomes

In Australia’s prestige housing market, the selling agent is no longer a mere intermediary but a strategic supplier whose choices can shift outcomes by seven figures. The differentiators are no longer ...Read more

Property

The new battleground in housing: how first-home buyer policy is reshaping Australia’s entry-level market

Government-backed guarantees and stamp duty concessions have pushed fresh demand into the bottom of Australia’s price ladder, lifting values and compressing selling times in entry-level segmentsRead more

Property

Property 2026: Why measured moves will beat the market

In 2026, Australian property success will be won by investors who privilege resilience over velocity. The market is fragmenting by suburb and asset type, financing conditions remain tight, and ...Read more

Property

Entry-level property is winning: How first home buyer programs are reshaping demand, pricing power and strategy

Lower-priced homes are appreciating faster as government support channels demand into the entry tier. For developers, lenders and marketers, this is not a blip—it’s a structural reweighting of demand ...Read more