Invest

How to save thousands on home renovations

By smartly managing cash flow, a $40,000 kitchen renovation could cost just $33,300.

How to save thousands on home renovations

By smartly managing cash flow, a $40,000 kitchen renovation could cost just $33,300.

If our passion for television show The Block is anything to go by, Australians like to renovate (or watch other people renovate). Many of my clients are joining an army of renovators and I can sympathise as my wife and I have just completed a kitchen renovation while expecting our second child.

If you are wanting to make some serious changes to your house, what is the best strategy?

Borrow to build

While many people borrow money to renovate, it can increase non-deductible debt. Renovations on your home are not tax deductible. For example, if you were to re-draw $40,000 against your home loan at current interest rates of around 4.50 per cent and assuming there are 16 years left on your principle and interest home loan, the interest and principle loan repayments will total $56,185 and your $40,000 kitchen renovation will actually cost $56,185.

Save your pennies

You could save $40,000 and start your kitchen renovation when you have the cash. This is the obvious option but for many people it means having to wait quite some time to be able to save the necessary amount.

Use a loan offset account

The third option, and the one that I’ve gone with, is keeping my cash in my home loan offset account and taking advantage of the interest-free purchase plans offered by some kitchen manufacturers and appliance retailers.

I have the cash saved for a renovation through good budgeting and control of my cash flow using an automated budget software tracking program.

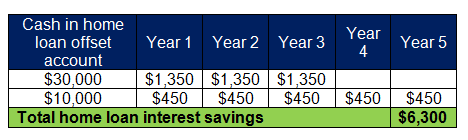

How does this work? For example, the kitchen manufacturer will provide a $30,000 interest-free loan with monthly repayments of $833 over 36 months. This does cost $540 more per month than borrowing money from a bank but it does result in an additional $30,000 sitting in the offset account.

The appliance retailer will provide 50 months’ interest free with nothing payable until the end of the 50 months. Knowing that the monthly repayments can comfortably be paid to the kitchen manufacturer, having the $40,000 sitting in your offset account will save $6,300 in interest over the next five years assuming a constant interest rate of 4.50 per cent on an interest-only home loan.

At the end of the three years, all of the payments to the kitchen manufacturer are finished and after five years there is cash sitting there ready to pay the appliance retailer. There is still $30,000 cash available for something else.

To make this work, you need the discipline not to spend the $40,000 on something else, but it does mean that a $40,000 kitchen renovation is now costing $33,300 by smartly managing cash flow. It’s a nice balance to have the kitchen renovation now but still have a large cash buffer on hand. If need be, the cash can be used to pay the suppliers at any point in time.

Things you need to be aware of include missing a monthly payment or not paying out the amount in full at the end of the interest-free period. This will often result in high interest rates being applied to the balance due (up to 20 per cent interest rates). There may be penalties for early repayment and obtaining interest-free finance may restrict your capacity for other loan applications. You need to make sure you read the terms and conditions of the interest-free finance agreement. Also, some suppliers do provide a discount if you pay upfront in cash. Keep that in mind too.

To conclude, any home renovation involves a large commitment of money and time. Having a disciplined approach to how you manage your cash to fund a renovation, combined with the right use of loan products and purchase offers from suppliers, can achieve a smart financial result. For me, the above approach means we have more cash in our offset account against our home loan saving non-deductible interest repayments. We still have access to cash in case of an emergency.

The above strategies use these financial tools (interest-free purchase plans and offset accounts) to your advantage. Using financial tools such as interest-free purchase options on their own often ends in financial disaster for consumers. Ultimately, applying financial discipline and having a clear strategy will achieve better financial outcomes.

Andrew Zbik, senior financial planner, Omniwealth

About the author

About the author

Property

Trust, technology and triage: what NSW’s ‘name and shame’ signals for real estate governance

NSW’s latest enforcement action on real estate trust accounts isn’t a one-off embarrassment; it’s a stress test of sector governance. With licences suspended and penalties applied, the message is ...Read more

Property

Vacancy is rising, demand is resilient: A case study in defending yield as Australia’s rental cycle rebalances

After a blistering run, Australia’s rental market is loosening at the edges. Vacancy is edging up off historic lows, rent inflation is set to moderate into 2026, yet underlying demand remains ...Read more

Property

From intuition to instrumentation: How a "two-stakeholder" sales playbook lifted close rates and cut cycle times

High-stakes consumer purchases are increasingly joint decisions. When one partner is under-served, deals stall. This case study follows an Australian real estate group that rebuilt its sales motion ...Read more

Property

Selling in 2025: How to spot bad agents fast—and build an ROI-first vendor playbook

In Australia’s property market, choosing the wrong listing agent isn’t just inconvenient—it’s a textbook principal–agent failure that can wipe tens of thousands off your sale outcomeRead more

Property

Selling in 2026: How to de‑risk your agent choice and protect tens of thousands at settlement

Choosing the wrong selling agent isn’t just an inconvenience — it’s a balance‑sheet risk. In a market where digital discovery is concentrated and AI is recasting how listings are priced and promoted, ...Read more

Property

Rate resilience in Australian housing: why scarce supply is overpowering monetary tightening

Australia’s housing market is defying higher borrowing costs because the binding constraint isn’t demand—it’s supply. Brokers report persistent buyer competition and investor repositioning, while ...Read more

Property

Victoria’s $100m renter support push: what it means for landlords, proptech and the housing economy

Victoria has unveiled a new suite of rental support services, including a dedicated helpline for renters aged 55+, underpinned by a funding package widely reported at around $100 millionRead more

Property

The multigenerational home moves mainstream: where the next margin lives in Australian real estate

Multigenerational living is shifting from edge case to core demand driver in Australia’s housing market. For agents, developers and lenders, the commercial upside lies in rethinking product design, ...Read more

Property

Trust, technology and triage: what NSW’s ‘name and shame’ signals for real estate governance

NSW’s latest enforcement action on real estate trust accounts isn’t a one-off embarrassment; it’s a stress test of sector governance. With licences suspended and penalties applied, the message is ...Read more

Property

Vacancy is rising, demand is resilient: A case study in defending yield as Australia’s rental cycle rebalances

After a blistering run, Australia’s rental market is loosening at the edges. Vacancy is edging up off historic lows, rent inflation is set to moderate into 2026, yet underlying demand remains ...Read more

Property

From intuition to instrumentation: How a "two-stakeholder" sales playbook lifted close rates and cut cycle times

High-stakes consumer purchases are increasingly joint decisions. When one partner is under-served, deals stall. This case study follows an Australian real estate group that rebuilt its sales motion ...Read more

Property

Selling in 2025: How to spot bad agents fast—and build an ROI-first vendor playbook

In Australia’s property market, choosing the wrong listing agent isn’t just inconvenient—it’s a textbook principal–agent failure that can wipe tens of thousands off your sale outcomeRead more

Property

Selling in 2026: How to de‑risk your agent choice and protect tens of thousands at settlement

Choosing the wrong selling agent isn’t just an inconvenience — it’s a balance‑sheet risk. In a market where digital discovery is concentrated and AI is recasting how listings are priced and promoted, ...Read more

Property

Rate resilience in Australian housing: why scarce supply is overpowering monetary tightening

Australia’s housing market is defying higher borrowing costs because the binding constraint isn’t demand—it’s supply. Brokers report persistent buyer competition and investor repositioning, while ...Read more

Property

Victoria’s $100m renter support push: what it means for landlords, proptech and the housing economy

Victoria has unveiled a new suite of rental support services, including a dedicated helpline for renters aged 55+, underpinned by a funding package widely reported at around $100 millionRead more

Property

The multigenerational home moves mainstream: where the next margin lives in Australian real estate

Multigenerational living is shifting from edge case to core demand driver in Australia’s housing market. For agents, developers and lenders, the commercial upside lies in rethinking product design, ...Read more