Invest

Homebuyers challenged by ‘severely undersupplied’ housing markets

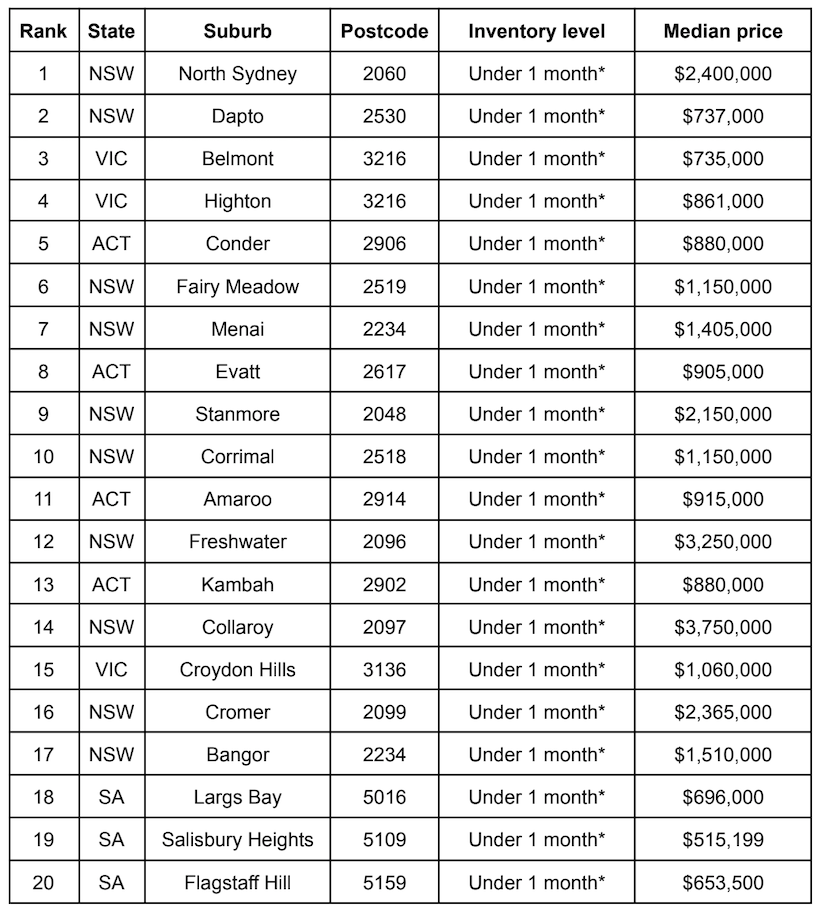

A new report has identified the 20 suburbs hit hardest by housing undersupply.

Homebuyers challenged by ‘severely undersupplied’ housing markets

Aussies looking to enter the property market in the nation’s most undersupplied housing markets are now facing significantly higher prices and increased competition.

Inventory levels are currently under one month in each of the top 20 undersupplied housing markets identified in a new report from HOOD.ai, with levels declining in 13 of the 20 markets during the past year.

Stock turnover levels, or the estimated share of houses in a suburb that sold during the past year, were under 4.9 per cent in 14 of the 20 markets, below the median for suburbs within 200km of a capital city.

The most undersupplied suburb in the country was found to be North Sydney with a median price of $2.4 million and stock turnover of 1.1 per cent.

“Part of the reason Australia has been experiencing a property boom is because stock levels have been low, which has forced buyers to compete harder and bid up prices,” said HOOD.ai founder and CEO Tommy Fraser.

“That story has really played out in these 20 suburbs, where inventory levels have been incredibly low over the past year. As a result, the median house price of most of these suburbs has experienced a double-digit percentage increase over the past year.”

Ten of the 20 most undersupplied housing markets were in NSW, including Dapto in second position with a median price of $737,000 and stock turnover of 4.2 per cent.

Meanwhile, four of the top 20 suburbs were in the ACT, three were in South Australia and a further three were in Victoria.

“Buyers desperately need new stock to come onto the market in all these suburbs, because right now, they’re in a terrible bind,” Mr Fraser said.

“When a house comes onto the market, do they offer a fair price and risk missing out? Or do they do whatever it takes to win the property but overpay?”

The suburb of Belmont in Victoria had a median price of $735,000 and stock turnover of 5.0 per cent, ranking as the third most undersupplied housing market in Australia.

Conder was the most undersupplied market in the ACT and the fifth most undersupplied nationally with a median price of $880,000 and stock turnover of 5.4 per cent.

In South Australia, the housing market of Largs Bay recorded a median price of $696,000 and stock turnover of 3.4 per cent, the most undersupplied suburb in the state and 18th nationally.

“It would be great to return to a balanced market, where owners enjoy reasonable capital growth and buyers have a reasonable chance of finding a property in their chosen suburb,” concluded Mr Fraser.

“For that to happen, these 20 suburbs need to see a significant increase in new listings.”

Property

Multigenerational living is moving mainstream: how agents, developers and lenders can monetise the shift

Australia’s quiet housing revolution is no longer a niche lifestyle choice; it’s a structural shift in demand that will reward property businesses prepared to redesign product, pricing and ...Read more

Property

Prestige property, precision choice: a case study in selecting the right agent when millions are at stake

In Australia’s top-tier housing market, the wrong agent choice can quietly erase six figures from a sale. Privacy protocols, discreet buyer networks and data-savvy marketing have become the new ...Read more

Property

From ‘ugly’ to alpha: Turning outdated Australian homes into high‑yield assets

In a tight listings market, outdated properties aren’t dead weight—they’re mispriced optionality. Agencies and vendors that industrialise light‑touch refurbishment, behavioural marketing and ...Read more

Property

The 2026 Investor Playbook: Rental Tailwinds, City Divergence and the Tech-Led Operations Advantage

Rental income looks set to do the heavy lifting for investors in 2026, but not every capital city will move in lockstep. Industry veteran John McGrath tips a stronger rental year and a Melbourne ...Read more

Property

Prestige property, precision choice: Data, discretion and regulation now decide million‑dollar outcomes

In Australia’s prestige housing market, the selling agent is no longer a mere intermediary but a strategic supplier whose choices can shift outcomes by seven figures. The differentiators are no longer ...Read more

Property

The new battleground in housing: how first-home buyer policy is reshaping Australia’s entry-level market

Government-backed guarantees and stamp duty concessions have pushed fresh demand into the bottom of Australia’s price ladder, lifting values and compressing selling times in entry-level segmentsRead more

Property

Property 2026: Why measured moves will beat the market

In 2026, Australian property success will be won by investors who privilege resilience over velocity. The market is fragmenting by suburb and asset type, financing conditions remain tight, and ...Read more

Property

Entry-level property is winning: How first home buyer programs are reshaping demand, pricing power and strategy

Lower-priced homes are appreciating faster as government support channels demand into the entry tier. For developers, lenders and marketers, this is not a blip—it’s a structural reweighting of demand ...Read more

Property

Multigenerational living is moving mainstream: how agents, developers and lenders can monetise the shift

Australia’s quiet housing revolution is no longer a niche lifestyle choice; it’s a structural shift in demand that will reward property businesses prepared to redesign product, pricing and ...Read more

Property

Prestige property, precision choice: a case study in selecting the right agent when millions are at stake

In Australia’s top-tier housing market, the wrong agent choice can quietly erase six figures from a sale. Privacy protocols, discreet buyer networks and data-savvy marketing have become the new ...Read more

Property

From ‘ugly’ to alpha: Turning outdated Australian homes into high‑yield assets

In a tight listings market, outdated properties aren’t dead weight—they’re mispriced optionality. Agencies and vendors that industrialise light‑touch refurbishment, behavioural marketing and ...Read more

Property

The 2026 Investor Playbook: Rental Tailwinds, City Divergence and the Tech-Led Operations Advantage

Rental income looks set to do the heavy lifting for investors in 2026, but not every capital city will move in lockstep. Industry veteran John McGrath tips a stronger rental year and a Melbourne ...Read more

Property

Prestige property, precision choice: Data, discretion and regulation now decide million‑dollar outcomes

In Australia’s prestige housing market, the selling agent is no longer a mere intermediary but a strategic supplier whose choices can shift outcomes by seven figures. The differentiators are no longer ...Read more

Property

The new battleground in housing: how first-home buyer policy is reshaping Australia’s entry-level market

Government-backed guarantees and stamp duty concessions have pushed fresh demand into the bottom of Australia’s price ladder, lifting values and compressing selling times in entry-level segmentsRead more

Property

Property 2026: Why measured moves will beat the market

In 2026, Australian property success will be won by investors who privilege resilience over velocity. The market is fragmenting by suburb and asset type, financing conditions remain tight, and ...Read more

Property

Entry-level property is winning: How first home buyer programs are reshaping demand, pricing power and strategy

Lower-priced homes are appreciating faster as government support channels demand into the entry tier. For developers, lenders and marketers, this is not a blip—it’s a structural reweighting of demand ...Read more